The Big Picture On Buying A Foreclosure Home:

- Buying a foreclosed home can provide significant savings compared to market prices, offering opportunities for both homebuyers and investors to purchase properties at a discount.

- Thorough research and due diligence is non-negotiable. This includes checking for any legal issues, understanding the property’s condition, and accurately assessing renovation costs.

- Various financing options exist for purchasing foreclosed properties, including FHA 203(k) loans, VA loans, and programs like Fannie Mae’s HomePath. Review your options and make the best choice depending on your circumstances.

Disclaimer

The information provided on this website is for general informational purposes only and should not be construed as legal, financial, or investment advice.

Always consult a licensed real estate consultant and/or financial advisor about your investment decisions.

Real estate investing involves risks; past performance does not indicate future results. We make no representations or warranties about the accuracy or reliability of the information provided.

Our articles may have affiliate links. If you click on an affiliate link, the affiliate may compensate our website at no cost to you. You can view our Privacy Policy here for more information.

Heard that you can score a great deal when you buy a foreclosure home for real estate investments?

Buying foreclosed homes soared in popularity during the Great Recession as a wave of foreclosures hit the market and drove down prices nationwide. While foreclosure rates since then have fallen—270,222 in 2023, a steep drop from 2019’s numbers—there are always people who default on their mortgages.

And for real estate investors and homebuyers alike, distressed properties spell opportunity.

But learning how to buy foreclosure properties isn’t as simple as TV shows make it out to be. To begin with, you have to understand the foreclosure process — and how the strategies for buying foreclosures differ at each phase.

Home Foreclosure Process

When a borrower defaults on their monthly mortgage payment, it triggers a lengthy legal process:

| Stage | Description |

|---|---|

| Missed Payment Outreach |

15 days late: Informal notice sent by lender. 36 days late: The lender must reach out again. 45 days late: Written demand letter sent, including loss mitigation and repayment options. |

| Notice of Default |

90 days: Official notice of default after three consecutive missed payments. 120 days: Legal foreclosure action will be initiated. |

| Filing of Foreclosure Complaint | The bank hires a law firm to file a lawsuit in court. The borrower now owes legal fees in addition to late fees. |

| Notice of Trustee’s Sale | The lender’s attorney schedules a foreclosure date and sends an official notice to the borrower. The foreclosure sale is advertised publicly. |

| Trustee’s Sale (Public Auction) | Property is auctioned, typically at the local courthouse. Bidding often starts at the total amount owed, including late and attorney fees. |

| Transfer of Legal Ownership | It can take a couple of months from the sale until the deed ownership changes hands. |

| Eviction | The new owner must go through the eviction process to remove the previous homeowners if they remain as squatters. |

| Real Estate Owned (REO) | If the lender acquires the property at auction, it is listed for sale through a real estate agent. |

How to Buy a Foreclosure Home

The strategy and steps to buy a foreclosed home depend on the stage of the foreclosure process when you choose to buy.

Buying Short Sales

In the early stages of mortgage default, homeowners — and their lenders — have more flexibility. If the property is upside-down, the lender may agree to a short sale: a loan payoff lower than the balance owed.

But lenders are fickle, bureaucratic beasts; you can expect extra red tape in the short sale process. It’s also hard to find good deals on properties offered on short sales, as lenders are loath to discount the loan payoff below the property’s market value.

Some investors find a way to make it work, but most opt to target pre-foreclosure homes instead.

Buying a Pre-Foreclosure Home

Once the lender hires an attorney and files for foreclosure in court, there’s no more Mr. Nice Guy. The borrower has had at least four months to bring their loan current, agree to a payment plan, or sell the home, and they haven’t done any of those.

Now the homeowner is under the proverbial gun, with an auction date looming. They need to sell now or lose their home at auction.

That urgency can make for motivated sellers. But it also puts you on a tight timeline to secure financing and settle.

When I first started investing in real estate, I bought pre-foreclosure homes. I found that most distressed homeowners didn’t want to sell — they wanted to stay in their homes.

One way to get their attention is to offer to buy their home and lease it back to them. You then enter an installment contract for them to rent the property from you and buy it back.

If you really want to get creative, keep their mortgage in place and use a wrap-around mortgage to finance your portion. That works especially well if they have a low-interest mortgage.

As for where to find pre-foreclosure homes, you can always go to the courthouse to look up foreclosure filings directly, but that’s a lot of work. Alternatively, just use an off-market distressed property platform like Propstream or Foreclosure.com.

Buying at Foreclosure Auctions

Anyone can show up and bid at a public foreclosure auction. You just need to provide proof of funds for the down payment — often a bank check made out to yourself, which you can later cancel.

The problem, however, is that you can’t see the inside of the property. The bank doesn’t own it then; it still belongs to the defaulting property owner. So you have no idea what kind of condition the property is in. It could look perfect outside and be a shell on the inside.

Or it could be pristine. You just don’t know.

Unless, of course, you do. If you have previously gained access to the property, for example, by meeting with the homeowner there to discuss selling options, then you have insider information.

Remember, the lender typically sets the opening bid at the total amount owed on the loan, which includes massive late fees and legal fees. Only bother bidding at foreclosure auctions where the property still has plenty of equity.

Buying Bank-Owned REO Properties

If no one buys the property at public auction, the lender buys it themselves.

After jumping through the legal hoops to take ownership of the deed and possibly evicting the former homeowners if they refused to leave, the bank hires a Realtor and decides whether to sell the property as-is or make some repairs first. Then, it goes on the market, listed on the multiple listing service (MLS).

At this point, anyone can walk through the property and make offers. If the property needs significant repairs, you’ll get the “Needs TLC” price, but that’s still the market price. You’re bidding against every other Tom, Dick, and Harry out there.

Unless, of course, you can get a first glimpse of these bank-owned properties. While huge corporate banks follow procedures to the letter, local and regional banks are more accessible. There’s probably one person in charge of REO properties at these banks, and if you can establish a relationship with that person, you can sometimes get first access to their REO list before they go through the hassle of hiring a real estate agent.

It makes sense for the bank, too. They can sell the property faster without having to pay a realtor’s commission on foreclosure listings.

Read more about how to buy REO properties if you like this strategy.

Buying Government-Owned Foreclosure Properties

What happens when homeowners default on government-backed loans like FHA and VA loans?

If no one buys them at auction, the government returns them instead of the lender.

Expect some extra steps and red tape, of course, but in exchange, you can sometimes score a great deal on government-owned foreclosed properties. You can view the list of government REOs on the Department of Housing and Urban Development (HUD) website.

Where to Find Foreclosure Homes

When a lender files for foreclosure, it becomes a public record at the local courthouse. You can go there and look up the latest filings. I did this for my boss once upon a time, in my early 20s.

But that’s an outrageously inconvenient way to find foreclosures.

For an easier option, you can check the local legal announcement publication where foreclosures are announced. It’s free, but still not very convenient.

The fastest and most convenient way to sift through foreclosure filings is an off-market property platform like Propstream or Foreclosure.com. You choose a geographical area and select which types of distressed properties you want to view, and it maps them out for you. Easy peasy.

You can get a preview of how Foreclosure.com works here:

Granted, these platforms aren’t free, but they work wonders. In addition to foreclosures, you can also find tax liens, tax sales, divorces, judgments, and other distressed sellers.

For REO properties, check out the HUD website above, which lists them, and also see Fannie Mae’s HomePath website and Freddie Mac’s HomeSteps website, which lists REOs.

Some larger lenders also list bank-owned foreclosures on their websites. For example, check out the REO homes for sale from Bank of America and Wells Fargo.

How to Finance Foreclosed Properties

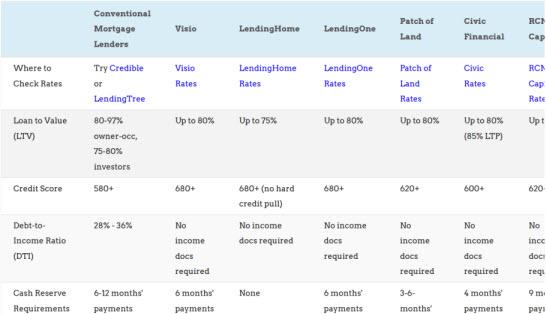

To finance foreclosure properties, you can use conventional loans, hard money loans, or portfolio loans. The right loan type depends on the property’s condition and your needs as a borrower.

If the property is in move-in condition, you can use a conventional loan such as a Freddie Mac or Fannie Mae loan for investment properties. These work especially well if you plan to house hack and move into the property for at least a year. Try Credible to compare interest rates and find the best conventional mortgage loan.

Fannie Mae offers a HomePath ReadyBuyer program designed to help first-time homebuyers buy a foreclosed home owned by Fannie Mae with up to 3% assistance towards closing costs. But there’s no free lunch, and you have to jump through some hoops, such as a mandatory online homebuying course.

If the property needs significant renovations, you could use a 203K loan if you plan to move in yourself. But if you plan to buy a fixer-upper as an investment property, you’ll need a hard money loan — a short-term purchase-rehab loan. Try Forman Loans, Kiavi, or New Silver as reputable options for purchase-renovation loans.

Once you complete renovations, you can sell the property as a flip or refinance it as a BRRRR deal. You may even be able to pull out your original down payment when you refinance and score infinite returns. Good long-term lenders for rental property loans include Visio, Kiavi, New Silver, and Forman Loans.

Portfolio lenders and hard money lenders often allow you to borrow the down payment as well, unlike conventional lenders. You can open unsecured business lines of credit through services like Fund&Grow, and tap into these credit lines and cards to help cover your down payment or renovation costs.

Finance Option Snapshot

| Financing Option | Pros | Cons |

| FHA 203(k) Loans |

– Low down payment – Finance renovation costs |

– Requires mortgage insurance – Limited to owner-occupied homes |

| HomePath ReadyBuyer Program |

– Up to 3% closing cost assistance – Low down payment options |

– Only applicable to Fannie Mae-owned properties |

| HomeSteps Program |

– No mortgage insurance required – No appraisal at origination |

– Limited geographical availability – Only applies to Freddie Mac properties |

| VA Loans |

– No down payment required – No mortgage insurance |

– Must be eligible veteran or service member – Property must meet VA standards |

| USDA Loans |

– No down payment required – Low mortgage insurance rates |

– Geographic restrictions – Income limits apply |

| Seller Financing |

– Flexible terms – Can bypass traditional lending requirements |

– May require a large down payment – Not all sellers offer this |

| Hard Money Loans |

– Quick approval and funding – Good for investors looking to flip properties quickly |

– High interest rates – Short repayment periods |

| Lease Option to Buy |

– Lock in purchase price upfront – Time to improve credit or save for a down payment |

– Non-refundable option fee may be required – Market prices could decrease |

| Bridge Loans |

– Immediate access to funds – Allows for the purchase without having sold your current home first |

– High interest rates – Must be repaid quickly once the original home sells |

| Crowdfunding |

– Access to capital without traditional lending standards – Potential for creative investment terms |

– Returns and control are shared with investors – Requires a compelling investment pitch |

Pros of Buying Foreclosed Homes

Why do people buy foreclosure homes?

In a word, bargains. You can often score great deals if you learn how to buy foreclosure properties.

The best deals tend to come from pre-foreclosure properties but are also more work. You have to set up outreach campaigns such as direct mail, which costs money and effort. Homeowners in foreclosure are notoriously difficult to work with.

It’s far easier to buy bank-owned REO properties. You can still often find decent deals on REO homes, especially if you build relationships with REO managers at local and regional banks. Just don’t expect the kinds of discounts you might be able to score buying preforeclosures.

Cons of Buying Foreclosures

Foreclosures come with more headaches than buying homes from “normal” sellers.

As outlined above, it takes work to reach homeowners in pre-foreclosure. And even once you establish contact with them, they can prove fickle and fearful, prone to changing their mind a half dozen times in a week.

Bank-owned REOs are easier, but banks don’t make ideal sellers either. Expect plenty of red tape and a slower sales process.

Government-owned foreclosed homes come with even more bureaucracy. You’ll need to provide more documentation, and you can expect delays from start to finish.

While not a con per se, many foreclosures are fixer-uppers. That can add to the discount, but it also adds labor and risk. You need to understand the exact condition of the property, and precisely what repairs are needed. To do so, consider the following steps:

-

- Conduct a thorough inspection with a qualified home inspector.

- Estimate repair and renovation costs realistically, including a buffer for unforeseen expenses.

- Research the property’s history for liens, taxes owed, and legal issues.

- Secure financing with terms that account for the renovation period.

- Consult with real estate professionals experienced in foreclosures and renovations.

- Understand the neighborhood’s market dynamics and future development plans.

- Verify zoning laws and restrictions that may affect your renovation plans.

- Consider the resale value and potential rental income of the property.

- Have a clear exit strategy in case the project does not proceed as planned.

- Allocate a contingency fund for unexpected repair costs and delays.

- Obtain comprehensive property insurance that covers renovation-related risks.

- Legal review of all documents to ensure clear title and ownership transfer.

And, of course, you need to budget accurately.

(article continues below)

FAQs About Buying Foreclosed Homes

Still have questions?

Here are a few of the more common questions about how to buy foreclosed homes.

Is there special financing available to buy a foreclosure home?

Sort of. The closest is Fannie Mae’s HomePath ReadyBuyer program, outlined above.

Freddie Mac offers a similar program through HomeSteps to sell off its REO properties. The program only operates in a handful of states, but it waives mortgage insurance even for down payments lower than 20%.

Otherwise, you can use FHA 203K loans, Fannie Mae HomeStyle loans for fixer-uppers, or any conventional loan for habitable properties. For investment properties, use a hard money loan or portfolio loan.

Can you buy a foreclosure with a VA loan?

Yes. If you qualify for a VA loan, that is.

Do I need good credit to buy a foreclosed house?

No more so than any other house. Better credit scores typically mean better interest rates and lower points and fees.

Who should buy foreclosure properties?

Anyone looking for a bargain on a property who doesn’t mind the extra headaches involved. Remember that many foreclosure homes have deferred maintenance and need some TLC, as real estate agents call it. After all, if the previous owners couldn’t afford the mortgage payment, they probably couldn’t afford the cost of repairs and maintenance.

Should You Buy Foreclosed Homes?

Buying home foreclosures isn’t for everyone.

Many of them need extensive repairs, so you need to feel comfortable working with contractors or doing home improvements yourself. Whether you buy pre-foreclosures directly from the homeowner, bank, or a government agency, expect more hassles than a traditional home purchase.

For your trouble, you can often score a lower purchase price than you’d find among the broader real estate market listings. Just ensure the juice is worth the squeeze, and you don’t find yourself in over your head.♦

Have you ever bought a foreclosure property at auction? What about preforeclosures or REO properties? Tell us about your experiences.

I’ve been tempted before to buy a foreclosure home because of the low price, but I was also worried about the possible problems and pitfalls. Going to take a second look at buying foreclosure properties, might start with REO’s then look into the more complex process of buying preforeclosures.

Keep us posted Jhen!

I gotta admit, the whole auction thing makes me a bit nervous! I don’t really know how competitive bidding works. Still, I’m open to learning more about it because the potential benefits of snagging a good deal are worth it to me. So, I’m ready to dive in, learn the ropes, and make the most of the opportunities that come with buying foreclosed homes.

Glad to hear it Ron!

Are there any legal or financial resources available to help protect buyers from potential scams or fraudulent activities in the foreclosure market?

The main protection is just hiring a title company to do a title search and buying title insurance. You just want to protect yourself against fraudulent sellers who don’t actually own the property.

I bought a foreclosure property last year, I managed the repairs myself and hired experts to help with things like HVAC. Definitely a learning experience, had plenty of hiccups. But made a profit on it and looking forward to doing the next one.

The first property is often the hardest John, glad to hear you’re moving along that learning curve!

Getting a foreclosure home at a bargain price was a game-changer for me. The lower purchase cost meant higher rental income, making it a profitable investment that brings in steady cash flow.

So glad to hear it Rock!