When I first started dating my (now) wife, she saw me lose money on a real estate deal. As a first impression for real estate investing, it left a lot to be desired.

And it’s been a long road since, in warming her to the enterprise of real estate investing.

It’s a common dynamic: one spouse becomes intrigued by real estate, while the other is skeptical. The skeptical spouse has an easy argument too:

“You want to put all of our hard-earned money into some real estate pipe dream? Are you crazy?!”

Don’t get me wrong, a degree of skepticism is healthy in evaluating any investment; stocks, bonds, real estate, gold, cryptocurrency, you name it. But being too conservative is no better than being reckless. Leaving money in cash results in a guaranteed loss of around 2% a year to inflation, making it the riskiest choice of all.

If your spouse opposes your dreams of building passive income through real estate investing, here’s the ultimate persuasion strategy to win them over, heart and soul.

Stage 1 of Your Master Plan: Reframe the Conversation

You’ll never win this argument on your spouse’s terms and assumptions. You’ll need to shift the entire framework of the conversation to reflect the realities of real estate investing, not their assumptions about it.

Reframing Part I: Earning, Not Spending

In all likelihood, your spouse is looking at a prospective real estate deal through the lens of “spending” money. All they hear is “I want to take $30,000 of our money and buy something with it.”

Which, of course, misses the point of rental investing. The point is to earn money, not to spend it.

The first step in reframing the conversation is to make it about generating extra income every month. Shift the conversation to be about the monthly cash flow you can expect, and what you and your partner should do with it.

Tap into their dreams, their hopes, their desires. Do they want to travel more? Cut back on their working hours to spend more time with the kids? Have more date nights?

Ask them about it. “Hey honey, if we could generate $500/month from the right property, what would you want to put it toward?”

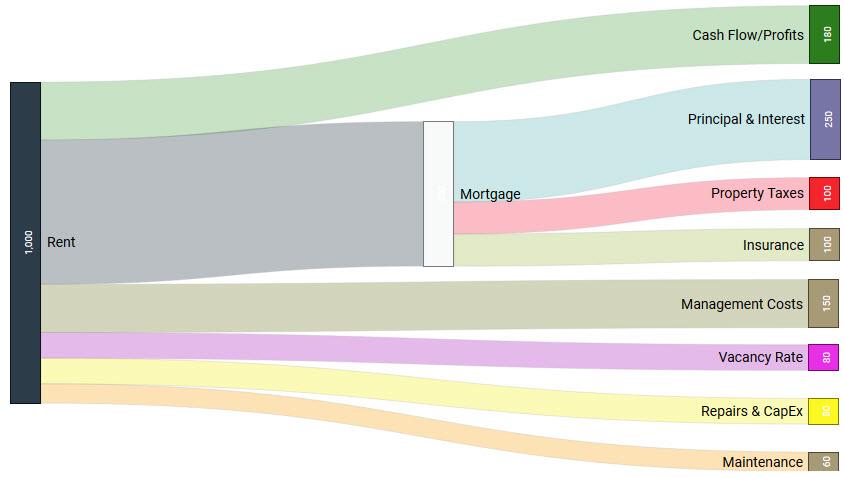

You could even show them a Sankey diagram of how rental cash flow moves, if you want an excuse to show off your vocabulary and expertise!

Reframing Part II: From “Whether” to “What Kind”

Most investment portfolios should have some diversification in real estate. That doesn’t have to mean direct ownership of course; you can invest in real estate indirectly through REITs, private notes, crowdfunding websites, syndication deals, even ETFs and mutual funds that own shares of home construction and commercial real estate firms.

But direct real estate ownership comes with perks ranging from leverage to control over returns to generous real estate tax deductions. Perhaps best of all, investors can predict with precision their returns, through calculating rental cash flow before investing.

Reframe the conversation away from “Here’s why we should move our money into real estate,” to “Let’s discuss our target asset allocation, and how much of our portfolio we want in stocks, real estate, and bonds.”

Because really, who can argue with diversification? I can’t.

Reframing Part III: Passive Income Provides Safety & Security

There’s an old adage that “the average millionaire has seven different sources of income.” As far as I can tell there’s no hard data to prove that, but to fixate on the number seven is to miss the point.

The point is that the wealthy create multiple streams of passive income, to earn money while they sleep. Or play with their kids, or golf, or travel the world.

Active income is great, but it has a cap of 40-50 hours a week. You can’t earn any more because you run out of time. But there’s no limit to the amount of passive income that you can generate.

The more sources of passive income you have, the less dependent you are on any one source of income – including your full-time job. Passive rental income, therefore, serves as a hedge against the loss of a job, creating security by diversifying your income sources.

And eventually, that passive rental income can replace your 9-5 income entirely. When that happens, congratulations: you’ve reached financial independence, and can retire young on rental income like Leif did at 32, or like the Thompsons did at 29.

Stage 2: Draw Them into the World of Real Estate Investing

Real estate investing is fun and exciting. You can transform homes! Create passive income! Build an empire!

But when many people first peer into this world, all they see is the risk and the unknown. And as we all know, the unknown is terrifying.

Take your doubtful partner by the hand and walk them step-by-step into the wide world of real estate with you.

1. Identify Objections & Fears (And Address Them)

My wife Katie is afraid of losing money, from bad tenants or endless repair expenses.

Those are real risks of course. There are plenty of irresponsible tenants out there, and sometimes properties need a new roof or furnace.

But there are simple ways to mitigate those risks. For example, landlords can avoid bad tenants through aggressive tenant screening, and by learning how to recognize and screen professional tenants, and avoiding lower-end neighborhoods. Landlords can minimize repair costs by implementing preventative maintenance, by properly estimating rental properties’ CapEx, and avoiding Section 8 tenants and their mandatory annual inspections.

Your spouse is afraid of something specific, whether it’s bad tenants ruining your rental property or contractors running off to Tijuana with your deposit or something else entirely. Find out what specifically has your spouse spooked, and learn how to mitigate that and other risks before buying your first rental property.

2. Show the Numbers

The numbers in a good rental property can be incredibly persuasive. But only to someone who’s “emotionally” primed and open-minded – all the charts and graphs and numbers in the world won’t convince someone who’s closed to the idea of real estate. That’s why you need to start by positioning your argument emotionally first, reframing it and addressing any fears or reservations.

But once the emotional barricades are down, start showing your significant other the logic and rationale behind rentals.

One simple place to start is with this sweeping study compiled by the University of California Davis, the University of Bonn, and the German central bank. It analyzed economic data from a variety of advanced economies over the last 145 years and found that rental properties offer both better returns than stocks and lower volatility and risk.

Showcase how rents rise over time, but mortgage payments stay fixed. In a typical year in the US, rents rise by 2-4%. For a visual breakdown, check out this graph showing 35 years in the life of a rental property:

I conservatively set non-mortgage expenses at 50% of the rent, in the example above.

You can also sit down together and play around with our free rental income calculator, to run numbers ranging from mortgage payments to cash flow to cash-on-cash ROI to cap rates.

3. Outline the Tax Benefits

Some nerdy people (like myself) get excited about tax savings. Your spouse may be one of those people too.

Real estate comes with an impressive set of tax benefits, including “above the line” deductions that come off of your total rental income, so even if you take the standard deduction, you still get to take advantage of these deductions. Some of these deductions are paper expenses – expenses you can claim as deductions, even though you never had to shell out money for them. Examples include depreciation and the new 20% pass-through deduction.

You can write off mortgage interest too, again even if you take the standard deduction. Read our full guide to tax deductions for landlords here.

But beyond deductions, rental properties offer the opportunity to roll gains into higher-income investments, through 1031 exchanges. When you sell a rental property, you can avoid paying capital gains taxes by using your proceeds to buy a more profitable rental property.

You can keep doing that indefinitely, to keep growing your rental income without paying capital gains tax!

4. Invite Them to Join You in Learning About Real Estate Investing

Your spouse will never share your excitement about real estate investing as long as they think of it as “your thing.” Instead, do what you can to make it “our thing.”

One option is listening to real estate investing podcasts or audiobooks while driving in the car together. After all, they’re a captive audience while in the car, so you can expose them to the benefits and fundamentals to try and draw them in. Point out intriguing real estate homes and buildings as you are driving together. Include questions so that a discussion can follow. “What do you think of that location?” “Look at that building, what do you think of the brick façade?”

Email articles to your partner that you found particularly persuasive or intriguing. Over dinner or drinks, share what you’ve learned that day. Watch our free video series on rental investing together.

Work to transition them from skeptical outsider to joint strategist.

5. Involve Them in Forming a Real Estate Investing Strategy

Your spouse needs to feel part of the ownership of this venture. Not just life partners, also investing partners, business partners.

By now they hopefully have a grasp of some of the fundamentals. Discuss different investing strategies, from long-term rental properties to Airbnb and vacation rentals. Explore the idea of flipping houses or commercial real estate and beyond. Always ask for feedback, get them involved.

Choose a market where you want to invest-together. Remember, it doesn’t have to be your home city – you can buy turnkey rental properties long-distance.

Decide on a budget. How much are you willing to invest as a down payment? Plan on at least 20% for rental property loans, unless you decide to house hack, in which case you can put down as little as 3.5%. All the while, remember that you’re now in a business partnership, and your spouse has a say in all investing decisions.

6. Involve Them in Executing Your Strategy

Now that you’ve formed a plan together, it’s time to execute that plan together.

If you’re using a Realtor to scout on-market deals, hire the Realtor together. Alternatively, if you’re looking to buy off-market properties, check out real estate investing tools like Propstream to find potential deals, together!

If you’re investing locally, walk through prospective properties together. If investing long-distance, look over properties on Roofstock together. Here’s a quick overview of how to use Rooftstock to find rental properties anywhere in the US:

Vet contractors together. Form renovation plans together. Discuss offers and agree on them… together.

Get the idea? You’re 50/50 partners, so make sure your spouse knows they’re just as much a part of this investing team as you are!

7. Get the Whole Family Involved

One way to really sell this idea to your spouse is to incorporate the whole family into your real estate investments.

For example, this single mom rental investor didn’t have money for a babysitter, so she started bringing her ten-year-old daughter to help with showing vacant rental units. Her daughter took to the role and became her primary “spokesgirl” and leasing agent, charming prospective tenants as she walked them through vacant units and spouted off the benefits and amenities.

But you can also use real estate investing as a way to teach your kids about entrepreneurship and investing. You can teach them lessons about leverage, cash flow, expenses and budgeting, passive income, tax strategies, appreciation, even inflation and how rents keep pace with or surpass it.

Your kids certainly won’t learn personal finance and investing in public schools!

Most of all, you can teach them to think independently about generating income, rather than raising them to simply follow orders like a good employee.

You can even teach your kids home improvement, repairs, renovations. These are incredibly valuable life skills, in addition to the financial skills and wealth-mindset outlined above.

And if you don’t know much about renovation yourself, learn it together! Ask your contractor to show you and your kids how to perform basic operations. Or learn it on Youtube on the fly – you can learn any physical skill on Youtube these days.

(article continues below)

Stage 3: Contingency Plans

Your spouse completely jumped on board from Day 1, right? “Honey, you’re such a financial genius! How could I ever doubt you?!”

Well, that’s awesome. I’m jealous because that’s certainly not what my wife said.

If you tried all of the above, and your spouse remains completely disinterested in real estate investing, or openly hostile to it, fret not. You still have a few tricks up your sleeve that you can call upon.

1. Offer to Prove Returns

They’re skeptical. And a little skepticism is healthy.

So, offer to demonstrate the benefits and returns of real estate investing with less money than you’d need to buy a property yourself. One option is to partner with someone else, ideally an experienced investor who can show you the ropes. You can risk less of your hard-earned cash because you’re splitting the costs with another investor.

Alternatively, buy fractional ownership in a rental property through Arrived Homes or our Co-Investing program.

Another option is to lend a private note. I did that with my wife; we knew a couple who was seeing excellent returns in their rental properties, so we lent them a private note of $10,000, and earned a 12% annual return on it. It helped warm my wife to the idea of real estate as an asset class.

One way to dip your toe in the waters of real estate investing is through a REIT (real estate investment trust). REITs are traded on stock exchanges like ETFs or stocks, allowing you to buy shares instantaneously through your brokerage account. From your pajamas.

Or, try investing in a real estate crowdfunding website. Like REITs, some crowdfunding websites invest directly in real estate themselves and pay you a return based on how their pool of properties performs. Try Streitwise and Fundrise as two options that allow non-accredited investors to participate. I’ve had good experiences with both, which return 8-10% annually and consistent dividends every quarter.

Other crowdfunding websites lend money to real estate investors, rather than buying real estate themselves. Some even let you pick and choose the exact real estate deal you want to invest money in! Try Groundfloor as an option that allows non-accredited investors to participate. I particularly like how short-term the investment is, usually under one year.

Finally, you could consider a real estate syndication. Just beware that most real estate syndications are only open to accredited investors and have minimum investments that are probably higher than you’re looking for as a proof-of-concept.

2. Offer to Use “Your Own Money”

Every marriage is different, in how they split up finances. But in nearly every marriage, each partner has something they can call their own.

If your spouse is absolutely, positively, 100% opposed to real estate investing for some reason, use your own money. Even if you only have $500 to invest with at first, you can still invest it in a REIT or crowdfunding website.

Keep investing a little more each month, and when you earn your first $75 or $100 in returns from your real estate investments, take your spouse out on a date. As you pour the second glass of cabernet, casually drop this line: “By the way, tonight is brought to you courtesy of my real estate income.”

Your spouse will be impressed. It’s a real, tangible demonstration that real estate can improve your quality of life.

3. Consider House Hacking or a Live-In Flip

Who wouldn’t want to live for free?

That’s the premise behind house hacking: someone else pays your mortgage for you. It could be tenants in neighboring units (for example if you buy a small multifamily), or it could be a housemate, or an income suite, or a room or section of the property that you periodically rent on Airbnb. Or if you have children in their 20s, house hacking through your children with an FHA “kiddie condo” loan.

It could even be renting out storage space in the garage or bringing on a foreign exchange student – both of which Deni has done!

Another approach is the live-in flip. You buy a property that’s habitable but dated, move in, and over the next year or so you update and renovate it. When it’s completed, you sell it, and the proceeds cover your housing expenses for the last year. Pretty nifty, eh?

The only drawback with a live-in flip is that you have to move every year or two. That can get old.

Regardless, the ability to live for free is another tangible, visceral way to convey the benefits of real estate investing, and to get started with very little cash.

Final Word

Real estate comes with incredible benefits, from the predictable returns of rental cash flow to tax benefits to inflation-adjusted returns to diversification in your portfolio.

If your spouse is reluctant and skeptical, don’t blame them. The onus is on you to convey these benefits in a compelling way.

Use the framework above to bring your spouse around to the idea of real estate investing, grow your passive income, and start planning your financial independence and early retirement!

It took me some time to win my husband over to real estate investing. I feel like normally it’s the other way around, but he’s very conservative about money, so it took a while to get him on board to buy our first rental property.

And now he’s hooked 🙂

Glad to hear he’s come around Sandra! And thanks for the comment!

I’ve struggled with this. My wife is terrified at the thought of financial risk of any kind. Super high anxiety in general. I’ve been slowly warming her to the idea, and the strategy above will be a huge help I think.

Thanks for the great article!

I feel your pain Theo. But I’m glad she’s gradually warming to the idea 😊

Thank you for the tips about how you can convince your spouse about investing. My husband is still hesitant about the idea. I bet I could use this to win him over.

Haha, I hear you Sandra! I was in that same boat for many years myself 🙂

I like that you brought up the option of living in a house while renovating it so that you can sell it once it is complete. I have been trying to convince my wife into using our Christmas bonuses to invest in some extra property next year, but she feels that it is not practical. Hopefully, I can convince her to move into a house that we will eventually sell once we renovate it.

Love it Darrien! Yeah live-in flips can work out great, especially for handy people who can work on many of the repairs themselves.

The end goal of a couple should always be to achieve their financial goals. Real estate investing offers an easier route to financial success, making it a compelling option to consider.

Agreed Marky!