The Big Picture On How To Build Credit Fast:

-

- Regularly check credit reports for errors to ensure accuracy and taking steps to correct any discrepancies found.

- Effectively utilize your credit cards by maintaining low balances relative to credit limits and paying bills on time to demonstrate responsible credit management.

- Explore diverse credit-building tools such as secured credit cards, credit builder loans, and becoming an authorized user on someone else’s credit card to diversify and strengthen credit history.

Disclaimer

The information provided on this website is for general informational purposes only and should not be construed as legal, financial, or investment advice.

Always consult a licensed real estate consultant and/or financial advisor about your investment decisions.

Real estate investing involves risks; past performance does not indicate future results. We make no representations or warranties about the accuracy or reliability of the information provided.

Our articles may have affiliate links. If you click on an affiliate link, the affiliate may compensate our website at no cost to you. You can view our Privacy Policy here for more information.

Size matters. At least where your credit score is concerned.

Consider two would-be investors. Sandra has a high credit score, and qualifies for an 80% LTV loan at a 6% interest rate with two points.

Billy has shoddy credit. The lender offers him only 65% LTV, at 10% interest and four points. And to be honest, he’s lucky he got that offer; most rental property loans don’t allow credit scores under 620 (or 640, depending on the lender).

Both of them want to buy the same property: a $500,000 fourplex with gross rents of $8,000/month. Sandra’s loan would be $400,000, with $8,000 due in points at settlement, and a monthly payment of $2,398.20 (assuming a 30-year loan).

Billy’s loan would be $325,000 – he’d have to come up with $75,000 more in cash than Sandra. Yet he’d owe $13,000 in points at settlement, and his monthly payment would be $2,852.11.

Yikes!

So how can real estate investors improve their credit quickly? Here’s what you need to know as an investor, and how to build credit fast.

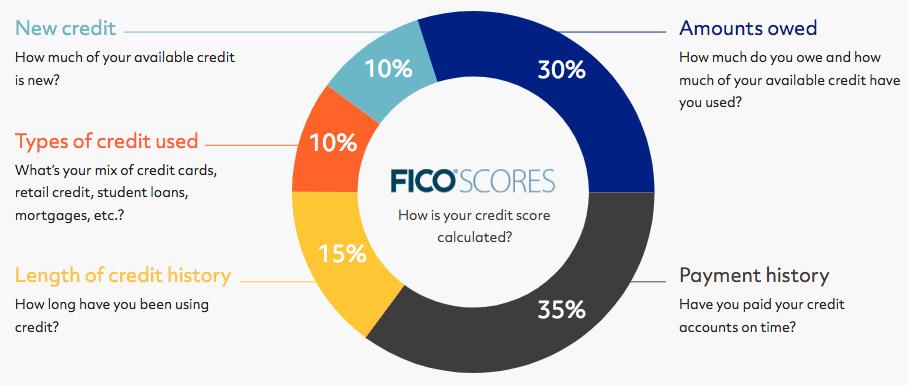

How Credit Scores Are Calculated

You’re probably familiar with the three main credit bureaus: Equifax, Experian, and Transunion. They each calculate credit scores slightly differently but use similar scoring models.

The most important factor is your payment history. If you make a payment more than 30 days late, it wreaks havoc on your credit score.

Next comes the percentage of available credit that you use. For example, if your credit card limit is $10,000, and your balance is $2,500, your credit utilization ratio is 25% (at least for that card). The credit bureaus like to see credit utilization ratios under 30%; they read it as “I’m not desperate, I’ve got my finances under control.”

They also like seeing a longer established credit history. Think about who you’d rather lend money to: someone with 20 years’ worth of good payment history, or someone with only 20 months’ worth of payment history?

Here’s a full pie chart showing how the credit bureaus calculate your credit score:

(Chart courtesy of Fundera)

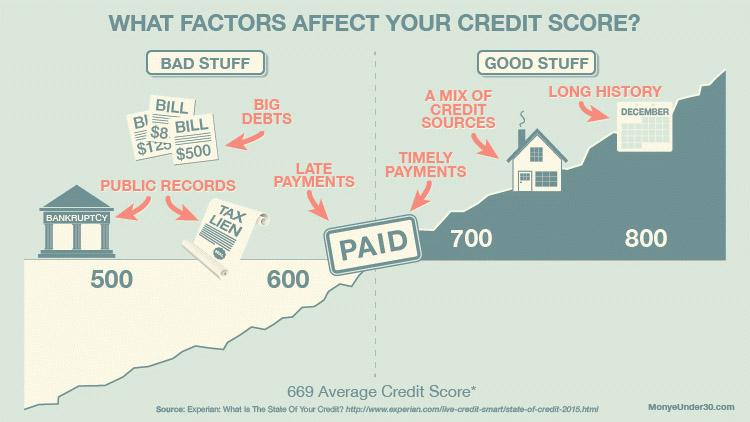

And since I love visual graphics (who doesn’t?), here’s another graphic showing good and bad factors that impact your credit:

(Chart courtesy of MoneyUnder30)

Finally, note that the mix of credit types matters too. We’ll circle back to that shortly.

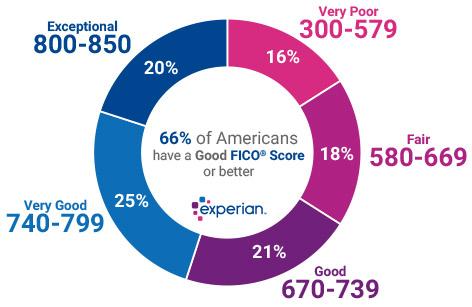

What’s a Good Credit Score?

We’re not going to pussyfoot around this question. If your credit is in the 500s, your credit s**ks. But hey, that’s why you’re here: to learn how to build credit fast.

Credit scores in the low 600s are also terrible. In the high 600s, they become merely mediocre. By the low 700s they’re all right, and by the high 700s they’re strong. Over 800 and you have excellent credit and can probably stop reading here.

Credit scores in the low 600s are also terrible. In the high 600s, they become merely mediocre. By the low 700s they’re all right, and by the high 700s they’re strong. Over 800 and you have excellent credit and can probably stop reading here.

Before you take too much comfort from the Experian chart to the right, it’s worth mentioning that your credit needs are greater than most as a real estate investor. A credit score of 600 is not “Fair” for you – you won’t qualify for a rental property loan. You’re held to a higher standard than Joe Six-Pack (whoever he is), so aim to build your credit score to 750 at least.

Keep in mind that the higher your credit, the lower your interest rate, the lower your fees, and the lower your down payment. You can check out today’s rates and compare loan terms at Credible to just how much of a difference credit scores make.

(article continues below)

7 Steps to Build Credit Fast

All right, now that you understand how credit works, let’s explore the nuts and bolts of building your credit score.

Step 1: Check Your Credit Report & Fix the Errors

The credit bureaus process billions of transactions every single day. You’re smoking crack if you think they don’t make mistakes all… the… time.

And look, it’s not their responsibility to ensure your credit report is accurate. It’s yours.

So, check your credit report for errors before you do anything else. Once a year, you can pull your credit report for free from AnnualCreditReport.com—it’s mandated by federal law.

While it’s free once a year, it’s not a complete credit report. It doesn’t include your credit score and isn’t particularly user-friendly. And once a year isn’t enough if you’re looking to build good credit.

Fortunately, you can run your own credit report (and other background checks) using the tenant screening feature in our landlord app. Depending on whether you’re using a free or premium account, the report costs between $9 and $15 and includes your credit score and complete credit history.

What do you look for when you pull your credit report? Look first for accounts that aren’t yours or accounts that should be reported but aren’t.

Next, look for incorrect late payments. If you paid on time, but your payments are showing as late, you need to contact the credit bureaus to let them know.

Lastly, look for any negative public records (bankruptcies, liens, foreclosures, etc.) that aren’t yours.

Credit bureaus make mistakes, and you must fix them if you want to build your credit.

Step 2: Get a Credit Card If You Don’t Have One

Yes, many people abuse credit cards. In fact, the average household credit card debt is up to $6,295 as of the end of 2023. Ugly.

But to establish your credit history, you need to have some credit records reporting. As a first credit card, don’t expect to be approved for the ritziest cards with the best rewards. Your first priority is building credit, not rewards.

If you get turned down for a traditional credit card, you have two options:

- Get a cosigner, such as a family member, to sign as a guarantor for your credit card or

- Get a secured credit card.

Secured credit cards require a deposit from you as collateral against default. If you fail to pay them, they just take the collateral. Then, they ruin your credit by reporting your default to the credit bureaus.

Use your credit card sparingly. As a first credit card, just put one recurring monthly bill on it and set up recurring monthly payments to your card to cover it. That way, it’s all automated, and you don’t even need to remember to pay for it.

Later, you can get fancy, like using your credit cards to buy real estate or score free travel, but right now, you just want to establish a credit history to build credit fast.

Bonus Option: Become an Authorized Signer on Someone Else’s Card

One alternative to having someone else cosign your credit card is becoming an added signer on someone else’s credit card. The credit bureaus report the card balance and payments on your credit history, too.

Just make sure the person is responsible about paying their card on time every month, and don’t use them unless you have their express permission. Building your credit isn’t worth ruining relationships over!

Step 3: Get a Credit Builder Loan

One credit card isn’t cut it when you’re looking to build credit quickly. Remember, part of your credit score calculation is based on your mix of credit accounts.

So, open a credit builder loan as another type of credit account. “Loan” is a misleading term, as you’re the one who’s lending the money. It works like this: you agree to make a series of payments over a certain period, say $40 monthly for 18 months. The “lender” reports your payments as on time throughout the loan, and you get your money back at the end of the loan term.

Well, most of it, anyway. They keep a little for the trouble of reporting your payments to the credit bureau. There is no such thing as a free lunch, after all!

But as you look for how to build credit fast, credit builder loans offer another tool in your kit.

Step 4: Diversify Your Credit Types (To A Degree)

Diversifying your credit accounts can be a good way to increase your credit score. The reason is self-explanatory—if you can juggle multiple credit lines simultaneously without dropping any of them, you demonstrate the type of financial responsibility lenders want to see.

Here are some of the different credit types you can try:

| Credit Type | How It Helps |

|---|---|

| Credit Cards | Shows ability to manage revolving credit |

| Installment Loans | Demonstrates reliability with fixed payments |

| Mortgage | Indicates responsibility with significant loans |

| Auto Loans | Reflects capability in handling term-bound debt |

| Retail Accounts | Helps by adding a mix of credit lines |

| Personal Lines of Credit | Offers flexibility and variety in credit management |

However, you shouldn’t go gung-ho with your applications. You need to space them out in a reasonable time frame (which we’ll discuss later.)

Step 5: Ask for a Credit Line Increase

Remember how the credit bureaus look at the ratio of credit used to credit available?

For rotating lines of credit (like credit cards), you can improve this ratio simply by getting a higher credit limit. If you routinely put $1,000 on your credit card every month, but your credit limit is only $2,000, then you’re using 50% of your monthly limit. Bump the credit limit to $5,000; suddenly, you only use 20% of your monthly credit.

As you build your credit history, creditors will be more willing to raise your credit limits.

Step 6: Have Your Rent Payments Reported to the Credit Bureaus

If you’re a renter, one way to build credit fast is by reporting your rent payments to the credit bureaus.

Of course, you don’t have complete control over this. You’ll need to ask your landlord to collect rent using a service that reports your payments. But it helps them, too, since it serves as an additional incentive for on-time rent payments.

We’re preparing to add this feature to our online rent collection service – hint hint!

Step 7: Consider Credit Repair Services

While not everyone needs credit repair services, they can be an effective tool for improving your credit faster.

They’ll handle credit reporting errors and disputes for you and show you exactly what to do to boost your individual credit score. In some cases, they can even negotiate on your behalf with creditors.

If you’d rather get some assistance than go it alone, check out Credit America, a great example of a credit repair service.

Credit repair services work by reviewing your credit history with a fine-tooth comb and identifying discrepancies and inaccuracies, including unfair and unverifiable claims. The timeline for results can vary from thirty days for simple issues to longer for more complex ones.

Sidenote: Any credit repair service that claims they can fix your credit score immediately is not to be trusted.

(article continues below)

Ongoing Habits to Build Good Credit

The steps above include the initial work to start building your credit score. But building and maintaining good credit is an ongoing project, not a one-time deal.

If you want to build credit quickly (and keep it), here’s what you need to keep doing.

Make Every Payment on Time Every Month

Payment history is the highest-weighted factor in your credit calculation. I won’t belabor the point, you get it, but you need to make damn sure you pay every loan, every credit card, every creditor on time, every single month.

No exceptions!

Here’s what you can do to get your payments in order:

-

- Set up automatic payments.

- Use banking app reminders.

- Schedule payment reminders on your phone/calendar.

- Align payment due dates with your pay cycle.

- Pay online immediately upon receiving your bill.

- Utilize email or SMS alerts from your credit card issuer.

- Check account regularly for the statement balance.

- Create a dedicated budget for credit card payments.

Pay Off Every Credit Card in Full Every Month

Don’t leave a balance on your credit cards.

First, it’s expensive. The card company charges interest if you leave a balance in place, and they don’t mess around with interest rates, typically charging 18-25%.

Second, it makes your credit utilization ratio high. That’s a massive factor in your credit scoring!

As a general rule, if you can’t afford to pay your credit card in full each month, you’re spending more than you can afford. Lock your credit card in a drawer until it’s paid in full, and stop spending so much. (If you’re serious about building wealth, try these ideas to live on half your income.)

Don’t Open Multiple Accounts at the Same Time

Every time you apply for a new credit account, whether a mortgage, personal loan, credit card, or whatever, the lender pulls your credit, and your score is temporarily lowered.

So, don’t apply to a bunch of new loans or credit accounts at once; doing so will drop your score significantly. If you can, wait at least a few months between credit applications.

Leave Your Old Credit Cards Open (Unless They Charge)

The older the average age of your accounts, the better, as far as the credit bureaus are concerned. So the notion that you should close your old accounts for your credit’s sake? Yeah, that’s a credit myth and completely untrue.

To keep that average age as old as possible, don’t open new accounts without a good reason, and don’t close your old accounts unless they charge an annual fee. Even if you no longer use the card, it helps keep your average account age high.

If you have a card that charges an annual fee, call the card company and tell them you’d like to close the card unless they waive the fee for you. Nine times out of ten, they’ll waive it.

Check Your Credit Report Regularly

Checking your credit for errors is not one-and-done. It’s an ongoing struggle against bloated, error-prone, gigantic corporations.

One option is credit monitoring services, which provide regular reporting and alerts. Some credit cards, by the way, include this feature as a perk.

Or you can just run them using our credit check service. Just sayin’.

“How Do I Start Investing Now with Terrible Credit?”

You do have options, even if you have bad credit.

Your best option is house hacking—you buy a home to live in yourself for at least a year and rent out rooms or adjoining units. As a bonus, you can live for free, or at least for a significantly reduced housing cost. Here’s how one young man with no real estate experience house hacked a duplex.

A nice benefit to house hacking is that you can get an FHA loan with only 3.5% down if your credit is as bad as 580 and a 10% down payment if your credit is between 500-579. Alternatively, Fannie Mae and Freddie Mac have loan programs with as little as 3% down. You can compare today’s interest rates, fees, and down payment requirements on Credible.

After a year, you can move out and keep the property as a rental—or you can keep living there for free!

Final Word

Anyone can build good credit quickly, but it does take a little (gasp!) work.

Follow the steps above as your guide to building credit fast, and just as importantly, make those ongoing credit habits part of your routine.

A good credit history pays ongoing dividends, especially for real estate investors looking for inexpensive rental property loans. The better your credit, the more options you have to finance your rental portfolio.

After all, this is one of the great advantages of real estate investing: leveraging other people’s money to build your asset portfolio. Don’t take it lightly; ignore your credit score at your peril.

What are you doing to improve your credit? How has credit impacted your ability to borrow and leverage other people’s money to build your real estate portfolio?

This is something I’ve been reluctant to tackle for a while now, just seems so insurmountable. But definitely something I need to work on. It’s affected my ability to invest.

Less insurmountable than you think Chelsea! The hardest part is just the discipline to keep doing the right things, month in and month out.

Definitely something I’ve struggled with after exiting a bankruptcy. A secured credit card and a credit-builder loan helped me some. My mortgage payments also helped.

Going to keep working at it, thanks for the article!

I would like to start looking to purchase my first rental property in about 6 months or so. I am hoping I can get my credit score up before then.

Best of luck Abe, and we have a lot of free resources available to help you buy your first rental, don’t hesitate to reach out with any questions!

Improving my credit has been a five-year slog, but I’ve raised my score by over 100 points. Still have a ways to go, and I’m going to try a couple tricks in this article to close the final distance. But financing rental properties has gotten MUCH easier since getting my score over 680.

People always underestimate how important your credit is. But as a real estate investor your credit literally determines your ability to earn a living.

Great overview on how to build credit quickly, thanks Brian!

Thanks Jacqueline, and I agree – super important for real estate investors!

Thanks for sharing these, been through this myself and even though I got to a 750+ score, it took me longer than it should have. Wish I’d paid more attention to articles like this at the time.

Thanks John, and even if it took longer than you’d like, at least you’re there now!

Great tips for building credit fast, much appreciated Brian!

Glad they helped Frank!

I found these helpful. Been working on building my credit for a little while now, hadn’t heard of a credit builder loan before but I’m going to try that.

Thanks for the comment Davies!

Nice article

Thanks Davis 🙂

I’ve been working on building my credit back up, seems especially important given the tight loan standards during the COVID-19 pandemic.

Quick question: does the new FICO Score 10 affect real estate investors?

Hey Darla, the new FICO Score 10 model won’t really affect real estate investors, at least not any time soon. Conventional mortgage lenders use much earlier FICO score models, and very few creditors will be using the FICO 10 scoring reports in the foreseeable future.

Regardless, it emphasizes mostly the same things: paying your bills on time, reducing your credit usage ratio, etc.

Best of luck!

Sometime ago, I got frustrated when my credit score hadn’t changed after months and months of dedication. I didn’t realize my performance wasn’t reported to the credit bureau. I eventually opened a couple new accounts that did report to the credit bureaus. A good reminder to check your own credit report regularly!

Yeah you definitely want to check your own credit report at least once or twice a year to see what’s being reported!

I shared this to my son who have a bad credit score. He’s now having a problem getting a loan to come up with a down payment and yet he still doesn’t care about his score! Anyhow, thanks for the tips!

Everything in life is more expensive when you have a bad credit rating.

I’m new to real estate investing and got my credit card a few days ago to build my credit score and other creative financing for purchasing my first rental property. I learned a lot from you blog! Thank you for sharing!

Glad to hear it’s been helpful Ibraim, keep us posted on how we can help!