To the uninitiated, investing in rental properties can look like a no-brainer route to financial independence and a steady passive income. After all, your tenants are covering your mortgage and other rental expenses, with little effort on your part!

But if you don’t do your homework before you take the plunge, your rental cash flow will falter at the first bump in the road. Rental investment rookies often learn this the hard way — as I almost did with my first rental property venture.

My husband’s and my first foray into investing in rental property, was actually repurposing our first home. Having lived there for a couple of years already, we were cocky. The area was a rental goldmine and we knew our expenses backward and forward.

But there were a few things we’d forgotten to factor in…

Rental Property Investing Newbies: Don’t Forget Non-Mortgage Expenses

As we were green at investing in rental property, we forecast our passive income by deducting the mortgage from the rent we planned to charge. That left us with a nice chunk of money every month even after paying our mortgage, we (naively) thought.

We were all set to advertise until a mortgage broker sent us tumbling back to earth. Apparently, our particular loan mandated a higher interest rate, as we were no longer owner-occupiers. We’d have to switch our homeowner’s insurance to a landlord’s policy.

Over the next 18 months, we saw our maintenance expenses, repair costs, property taxes, and vacancies all play a major role in our rental cash flow. It was a bitter dose of reality, reflecting the true cost of investing in rental properties.

We were lucky to get some good advice just before we set our rental price. So, let me pay it forward. Here’s a guide to investing in rental properties for beginners. Or: what every aspiring investor should know before they get started in rental real estate investing.

What to Do Before Investing in Rental Properties

If you’re new to investing in rental property, the golden rule is to always research as much as possible beforehand. This is true whether you’re buying a property or changing your status from owner-occupier to landlord.

Don’t gamble your well-earned money on an impulse buy. Instead, gather as much data as possible to ensure your property will actually cash-flow for you!

Converting Your Home into a Rental

If you’ve been living in the property before you lease it out, keep in mind you could lose any primary residence exemptions. That could mean a painful hike in property taxes and other local fees.

You may also have to switch your mortgage from a traditional loan to a rental property loan. This can mean stricter terms and higher interest rates. So, shop around before investing in rental properties and seek advice from local mortgage brokers.

Getting a Mortgage on a Rental Property

Getting a mortgage for a rental investment property often requires a higher down-payment than owner-occupied properties. So be prepared to shop around for a mortgage that will keep your real estate cash flow reliable.

Seek advice from a trusted mortgage broker or financial institution on what terms are best for you and your rental property. It could mean choosing between a short or longer-term loan, or a fixed or variable rate.

Location Research to Ensure a Better ROI

If you’re investing in rental properties the same way you’d shop for a home for you and your family, you’re doing it wrong. If you want to make sure your rental yields a good income, you need to evaluate the location like a landlord. An investor, focused on ROI.

If you’re investing in rental properties the same way you’d shop for a home for you and your family, you’re doing it wrong. If you want to make sure your rental yields a good income, you need to evaluate the location like a landlord. An investor, focused on ROI.

- Consider areas that are up and coming or being gentrified to get a better return on your investment.

- Research the property taxes in the area to get a better idea of your costs.

- Find out if the location is attractive to renters. What are the schools, crime rates and amenities like?

- Talk to other landlords or real estate agents to get an idea of the neighborhood’s vacancy rates.

- Ask the neighbors about the location and whether they’ve had any problems.

- If the rental property is far from your home or if you are managing multiple properties, look into management agencies in the area.

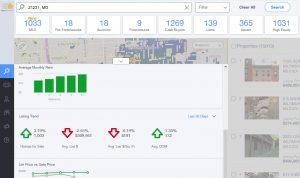

Try Propstream and Mashvisor as quick rental market analysis tools.

How to Calculate Your Rental Cash Flow

One thing that never dawned on me when I started out in rental property investing was the hidden expenses. As I’d been living in the apartment for a few years, I thought I had a good handle on the costs of living there.

Turns out I made the classic rookie mistake of not taking rental expenses into account. I’d thought that investing in rental properties would yield a straightforward passive income. But my cash flow would be at risk without factoring in costs like landlord insurance, capital expenditure and maintenance.

Luckily, we had people around us who knew better and set us right, and I’m eternally grateful. We set a rental price that would cover the expenses we could foresee. We also ring-fenced an emergency expense fund for any nasty surprises.

Since then we’ve had our share of sump pumps replaced and new furnaces installed. And that’s the rule, not the exception. But setting the right rent and having an emergency expense fund from the very beginning spared us many sleepless nights.

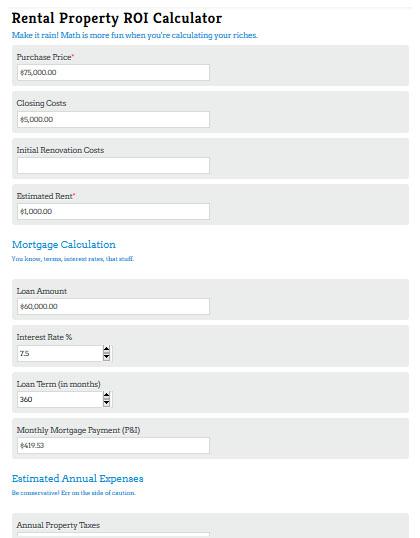

We calculated our rental property’s cash flow by hand, but you’re in luck. It’s now easier than ever to forecast future returns by using a rental property calculator (psst: ours is free!).

We calculated our rental property’s cash flow by hand, but you’re in luck. It’s now easier than ever to forecast future returns by using a rental property calculator (psst: ours is free!).

Maintenance and CapEx

The income on your investment property might be passive, but that doesn’t mean you should be laid-back about your investment. Rental properties need regular maintenance to keep them in good shape and to keep your tenants happy. When a bathroom tap starts to gush water or the dishwasher suddenly gives up the ghost, you cash on hand to quickly fix or replace.

Along with your garden variety repairs, there’s also capital expenditures or CapEx. These are the costly fixes like a new roof or a replacement furnace. Read more about CapEx here.

Vacancies & Turnovers

When calculating your cash flow margins, don’t forget to factor in turnover costs. Every time a tenant leaves, you need to clean and paint the property, advertise and pay the mortgage and bills. Tenants who don’t pay on time, cause damage or skip out on their lease will eat into your passive income.

Do your due diligence and you’ll get yourself a great tenant that will stick around for years to come.

Even if you have a cash-cow rental property in a hot location you’ll still have tenants come and go. In between tenants, you’ll need to freshen up the unit with new paint, cleaning, sometimes new carpets or flooring before showing. You must also factor in the time spent advertising the property and showing it to prospective renters.

The average vacancy rate is around 8% which works out to a month a year, but if your investment property is in a cooler market you should use a higher number.

Property Management Fees

If you only have one property and you’re a dab hand at home improvement, you might be happy maintaining it yourself. But what if you’re living in another city and the washing machine suddenly springs a leak?

A good property management agency is worth their weight in gold, especially when you have multiple properties. Believe me, you’ll need them if you’re a long-distance real estate investor.

Even if you use an automated landlord app like ours, still shop around for a reputable property management agency to keep in reserve if you need help.

Utilities

In a perfect world, your renter will pay the utilities themselves. But you might still get landed with the bills when the unit is vacant. So, make sure to include some money for utilities in your rental cash flow calculations before investing in a rental property.

Miscellaneous

Miscellaneous costs can include bookkeeping, accounting, lease agreements, automated landlord apps, and mileage. If you’re small fry you can absorb these costs, but if you have a suite of properties these costs will start to add up.

(article continues below)

Risks to Expect (and Mitigate) in Rental Property Investing

When I first started investing in rental property, I was already aware of the damage that a bad tenant can wreak on your investment. That’s because a good friend had converted their home into a rental, only to see it ruined by reckless tenants.

Our friend had leased his home to a family who skipped out on their rent after six months. Not only were the rooms filthy and all the furniture broken, but the carpets were scorched, and the kitchen walls blackened.

It cost thousands of dollars of his own money to fix these issues. As a result, he was scared off rental property investing for life.

I’m glad to say that this has never happened to us. And it’s because we’ve always taken steps to protect our income and investment. We make sure that reputable people are in our properties and we keep an eye on our investments.

A quality tenant means fewer repairs, less time spent dealing with issues and less wear and tear. And a long-standing tenant means you’ll save money on turnover and vacancy costs.

Tenant Screening

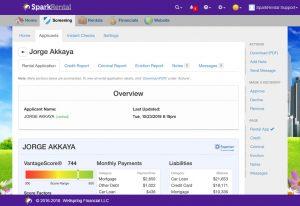

Before you even consider handing over your keys to anyone, you need to carefully screen your prospective tenants. That means running a thorough rental application process. This includes eviction, credit and criminal record checks, alongside landlord and employment references. (We offer a free rental application!)

Before you even consider handing over your keys to anyone, you need to carefully screen your prospective tenants. That means running a thorough rental application process. This includes eviction, credit and criminal record checks, alongside landlord and employment references. (We offer a free rental application!)

And to save yourself some time down the road, consider doing a pre-screening interview so that you’re only showing the property to qualified applicants.

When you run rental applications, you can select to include tenant screening reports as well: tenant credit reports, criminal background checks, and eviction reports.

Security Deposit

Always make sure to get a security deposit before your tenants cross the threshold. This will help protect yourself from late payments and minor damage done to your rental investment property. Plus, your tenants are more likely to take care of your property to ensure they get their deposit back when they move out.

A security deposit is not a failsafe against all damage though. My doomed friend’s security deposit only partially covered repairs to his wrecked house. Watch out for these security deposit mistakes to better protect your property from damage and defaults.

So, make sure to do proper tenant screening and protect yourself with an aggressive lease agreement.

Have an Ironclad Lease Agreement

It’s essential that you have an airtight lease to protect yourself legally when investing in rental properties. Each state imposes its own legal requirements for leases. But to truly protect yourself you should include state-specific lease clauses including:

- Due dates for payments

- Lease termination fees

- Late payment fees

- Occupancy and guest rules

- Property inspection frequency

Luckily for you, our state-specific lease agreement includes protective lease addenda and disclosures.

Defend Your Boundaries

You can include every lease clause under the sun, but it won’t matter unless you’re willing to enforce these rules. New landlords are often too timid to crack down on renters who consistently pay rents late and push boundaries.

To protect your rental property investment and rental income, set clear ground rules from the very beginning. If any bad behavior or habits rear their ugly head, remind your tenants of these lease clauses and issue any relevant fines. That way you’ll nip any issues in the bud and show them you’re serious about protecting your property.

Inspect Your Rental Investment Property Regularly and Often

As my friend learned the hard way, repairing your property after a bad tenancy can wipe out your precious passive income. So, keep on top of your investment by making routine inspections on a regular basis, at least every three to six months. These checks allow you to keep on top of any maintenance requirements and give your tenants a chance to fix any issues before they get worse.

Over to You

We’ve all learned lessons the hard way, and investing in rental property is no exception. Luckily, we had people around us who weren’t shy about sharing their advice and horror stories! And we’re very grateful they did, to help us learn real estate investing.

And even when you do everything right on paper you’ll still have bumps on the road when investing in rental properties. In my case, it was two couples moving out in two years because they broke up. My husband and I started thinking that unit was cursed.

Fortunately, we had made sure that our lease termination clause covered any turnover costs. And third time was a charm when we finally found the perfect tenant, who stuck around for years and took great care of our property.

There are always risks involved when investing in rental properties, but luckily you can mitigate these risks by researching taxes, vacancies, expenses, and potential tenants beforehand. And with an ironclad lease agreement and regular inspections, you’ll be on the road to financial independence in no time.

Have you any questions about investing in rental properties? Do you have anything to add about mitigating your risks as a rental property investor? Let us know in the comments!

More Landlording Reads:

About the Author

Yvonne Reilly is a landlord, property investor and solopreneur, passionate about helping people become financially independent and realizing their FIRE dreams. As a freelance writer, editor and digital marketer, she also helps small businesses connect with their audience and build traction. You can find out more about Yvonne on her website.

I want to commend you on your great services and education. I originally came on here to check out the masterclass you were offering and eventually started reading your blogs and using your tenant screening services. Your service was fast and reliable and very affordable! Keep up the great work!!

Thanks for the kind words Christopher, they’re much appreciated!