Buying Investment Properties

Among the most common questions I hear from new real estate investors surround how to find and evaluate deals. Try on these tips, as you go about scouring your target market for good deals.New Investors Always Underestimate Expenses

Nichole Stohler of Gateway Private Equity Group puts it succinctly: “Your numbers are probably wrong. “You rarely make the money you think you are going to make in the beginning. Despite reviewing actual property numbers, thoroughly analyzing them and having an inspection prior to purchase, there are still events that are difficult to predict.”

When new investors first learn about real estate investing, they almost always underestimate rental property expenses. Many fail to budget for vacancy rates, repairs, maintenance, property management costs, accounting and travel costs, and other expenses associated with owning and managing rental properties.

Use our free rental property calculator to help you forecast rental cash flow, and be conservative in your analysis!

Nichole’s parting advice: “Besides using actual property numbers in your analysis, plan for 30% more expenses in your first year.”

“You rarely make the money you think you are going to make in the beginning. Despite reviewing actual property numbers, thoroughly analyzing them and having an inspection prior to purchase, there are still events that are difficult to predict.”

When new investors first learn about real estate investing, they almost always underestimate rental property expenses. Many fail to budget for vacancy rates, repairs, maintenance, property management costs, accounting and travel costs, and other expenses associated with owning and managing rental properties.

Use our free rental property calculator to help you forecast rental cash flow, and be conservative in your analysis!

Nichole’s parting advice: “Besides using actual property numbers in your analysis, plan for 30% more expenses in your first year.”

Don’t Count on Appreciation

Robert Taylor, AKA The Real Estate Solutions Guy, lost $90,000 on his first rental property. “Cash flow is king. My first rental property had negative cash flow between the mortgage, expenses, and the rental income. I had to write a personal check every month for the difference between rent and the mortgage. I told myself it didn’t matter, that in time the property would appreciate. It helped that I also had a six-figure income to cover the negative cash flow.

“Unfortunately, the Great Recession hit and my income dropped significantly. Of course, the value of my rental property took a dive too, from $300,000 to $125,000. With no more extra income and a rental I couldn’t afford, I couldn’t afford to keep it any longer. This mistake ultimately cost me over $90,000 in hard, cold cash.”

Real estate doesn’t just go up in value – it can go down too. But rents are far more stable than home values, and almost never decline; see this graph of rents even during the Great Recession (blue is median, green is mean rents):

“Cash flow is king. My first rental property had negative cash flow between the mortgage, expenses, and the rental income. I had to write a personal check every month for the difference between rent and the mortgage. I told myself it didn’t matter, that in time the property would appreciate. It helped that I also had a six-figure income to cover the negative cash flow.

“Unfortunately, the Great Recession hit and my income dropped significantly. Of course, the value of my rental property took a dive too, from $300,000 to $125,000. With no more extra income and a rental I couldn’t afford, I couldn’t afford to keep it any longer. This mistake ultimately cost me over $90,000 in hard, cold cash.”

Real estate doesn’t just go up in value – it can go down too. But rents are far more stable than home values, and almost never decline; see this graph of rents even during the Great Recession (blue is median, green is mean rents):

Your Profits Depend on Your Due Diligence When You Buy

A common adage when you learn real estate investing is “You make your money when you buy, not when you sell.” The concept is simple enough: your profits, as either a flipper or a rental investor, will be determined by how much you pay for a property, compared to what it’s worth. In other words, the discount you can score. Jerryll Noorden, founder of We Buy Houses In Connecticut, explains that the lesson is far more nuanced than he originally thought. ”I thought I knew what that meant way back then. It means more than offering the right price. It means going that extra step, to check in that spiderweb-infested crawlspace to make sure the oil tank is not leaking. To make sure there are no termites, those ‘small’ things you know you should do, but for an unknown reason you just don’t.

“It was a thorough and expensive lesson to check everything!”

In other words, price is only half the issue. The other half is accurately assessing the property’s underlying value. It doesn’t matter if you pay less than the other properties in the neighborhood, if your property has a $20,000 termite problem!

Jerryll Noorden, founder of We Buy Houses In Connecticut, explains that the lesson is far more nuanced than he originally thought. ”I thought I knew what that meant way back then. It means more than offering the right price. It means going that extra step, to check in that spiderweb-infested crawlspace to make sure the oil tank is not leaking. To make sure there are no termites, those ‘small’ things you know you should do, but for an unknown reason you just don’t.

“It was a thorough and expensive lesson to check everything!”

In other words, price is only half the issue. The other half is accurately assessing the property’s underlying value. It doesn’t matter if you pay less than the other properties in the neighborhood, if your property has a $20,000 termite problem!

Don’t Assume Existing Tenants Will Go Quietly

Vivian Young with Website Greenlight learned firsthand that not all existing tenants leave when or how they say they will. She recommends: “Let the seller deliver tenant-free before opening escrow! “We were about to open a short escrow on a small house when our broker called and asked if we could grant the tenant another two weeks to move out. I didn’t feel comfortable about this. The house was on the market for six months and the tenant, on a month-to-month lease, looked like she wasn’t going anywhere. No moving boxes, no signs of packing up her belongings.

“As we dug further, the tenant was asking the seller for a move-out fee but they wanted to pass the burden of paying the financial ‘incentive’ to the buyers. We passed. The only thing we wanted to see in our new home was four blank walls, not inherit a tenant!”

It goes to show that not all expensive lessons need to be learned the hard way, as you learn real estate investing.

“We were about to open a short escrow on a small house when our broker called and asked if we could grant the tenant another two weeks to move out. I didn’t feel comfortable about this. The house was on the market for six months and the tenant, on a month-to-month lease, looked like she wasn’t going anywhere. No moving boxes, no signs of packing up her belongings.

“As we dug further, the tenant was asking the seller for a move-out fee but they wanted to pass the burden of paying the financial ‘incentive’ to the buyers. We passed. The only thing we wanted to see in our new home was four blank walls, not inherit a tenant!”

It goes to show that not all expensive lessons need to be learned the hard way, as you learn real estate investing.

Finding Good Deals Take Both Patience and Work

“A problem that I see with so many starting out real estate investors is the lack of patience,” explains Don Wede, President of Heartland Funding Inc. “They imagine that there is the magical deal tree and they can just go up to it and pluck a good deal right off. They need to learn that finding good deals is hard work and one must be persistent and patient that the deals will come.” Buying rental properties is not like buying stocks or ETFs or REITs. You can’t simply click a button on your brokerage account and buy it. If you want to make money in real estate, you need to invest time and effort in finding deals – and for that matter, in learning real estate investing. Wede continues: “To piggyback on this problem is the lack of dedication to education, in this field of real estate investing. You are jumping into a whole new industry, and education is paramount if you are going to succeed.” Try these tactics to help you find good deals on investment properties, even in a hot market.Generate More Leads Through a Website

One of the more unique tips I heard from investors about learning real estate investing centered around using a website to generate leads and score deals.

Earl White, founder of House Heroes, explains his journey to learn about real estate investing and finding deals: “I chased MLS listings my first two years investing. Even with auto-updates, follow-up, and hundreds of offers, deals were few and far between. I moved financial resources into direct-mail with moderate success, but direct-mail is an uphill battle with prospects overwhelmed with postcards and letters.

“Online lead generation changed the ball game. I opened my website in 2016. With a mixture of search engine optimization and pay-per-click, off-market motivated sellers were finding me – not the other way around. Even for direct-mail leads, prospects visit my website, see video testimonials, and call-in already comfortable with my company. Websites are also a great networking tool to display your work for lenders and partners.

“Websites are not expensive. A professional website costs less per month than going out to a restaurant. I threw hundreds of hours at MLS properties and thousands of dollars at direct-mail. My lean years would have ended much quicker had I invested in my online presence. Ranking in search engine results takes months in competitive markets, so delay can be costly.”

Read llc mortgage loan requirements.

Financing Investment Properties

Another broad category of questions I hear all the time from new investors surrounds financing.

“How can I fund my deals? Who should I borrow from? How much of the purchase price will lenders fund?”

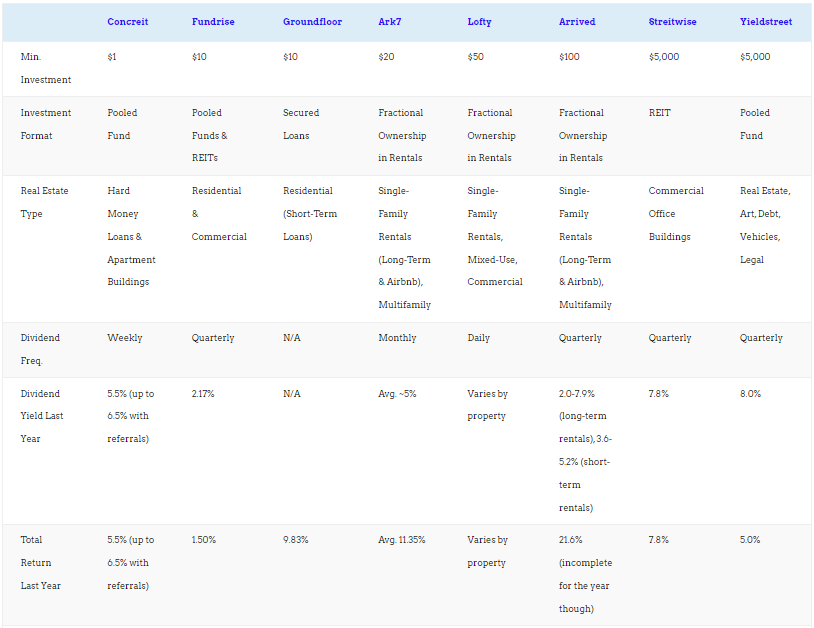

We answer a lot of those questions on our comparison charts for investment property loans that we’ve vetted. But here are some more tips from pro investors, as you learn real estate investing.

Leverage Cuts Both Ways

Leveraging other people’s money to build your own portfolio of assets can accelerate your gains exponentially – but it can also accelerate losses when you make mistakes.

And that’s the thing about learning real estate investing: in the beginning, you do make mistakes.

Mark Moss, founder and market analyst at Market Disruptors, explained how he initially earned excellent cash flow from single-family and small multifamily rentals – then he cashed out to invest everything in larger properties. “At the time, finding properties I could make $1,000 per month net was pretty easy and I knew if I got just ten, I would be set for life.

Mark Moss, founder and market analyst at Market Disruptors, explained how he initially earned excellent cash flow from single-family and small multifamily rentals – then he cashed out to invest everything in larger properties. “At the time, finding properties I could make $1,000 per month net was pretty easy and I knew if I got just ten, I would be set for life.

“But as the real estate market heated up, I moved into developing multi-million dollar properties, condo complexes and even mixed use. In order to do this level of properties, I need much more capital than I had worked with in the past.

“So I sold or refinanced all of my rental properties to get the capital I needed to do these larger projects. And in 2008, when the financial markets crashed, I was wiped out. I found myself millions of dollars in debt and unable to carry the properties because they would not cash flow and I didn’t have the income to sustain them.

“The properties I lost were sold for 40% of what I had built them for, and the new buyers made millions riding the real estate wave back up to where it is today.”

There are a few lessons in that story as you learn about real estate investing. First, don’t bet the farm. Mark says “I didn’t need to sell and refi all my properties, I could have kept half of them as rental income.”

Second, scale gradually, and use leverage as a tool for measured growth, not explosive growth.

Private Lenders Invest in You, Not Your Deal

Before explaining further, it’s worth defining the term “private lender” (often confused with “hard money lender”). A private lender is an individual who lends you money, such as a friend or family member. A hard money lender is in the business of lending to real estate investors.

Robert Taylor goes on to break down private lending like this: “Money follows trust. If people find you trustworthy, money will be readily available.

“I used to talk to people about my deals to see if they were interested. It was always a hard sell. After a while though, I built up a track record of successful deals and treating my lenders fairly. When this happened, people I had never done business with would tell me ‘If you ever need money for a deal, let me know.’

“My lenders now don’t even look at the properties they lend on anymore. They are investing in me because they trust me, not the deals. Focus on being a person people want to invest in.”

Managing Rental Properties Profitably

A recurring theme on our landlord blog is that better property management leads to better returns, while requiring less work from you.

“More money with less work? Why wouldn’t everyone follow property management best practices then?”

Because it’s preventative. It requires investing a little work up front to avoid more work three steps down the road. And how often does the average person puts in an hour’s work today to save a week’s work next month?

But you can do better than the average landlord. Here’s how.

The Quality of Your Tenants Determines Your Returns

Deni and I drive home this point all the time.

Benjamin Mizes, the CEO of Clever Real Estate, puts it like this: “The quality of your tenants is so important. If your properties are located in rougher areas with high cash flow, 1-bedrooms have higher turnover, but 2- and 3-bedrooms generally are better quality tenants who stay longer.”

Benjamin Mizes, the CEO of Clever Real Estate, puts it like this: “The quality of your tenants is so important. If your properties are located in rougher areas with high cash flow, 1-bedrooms have higher turnover, but 2- and 3-bedrooms generally are better quality tenants who stay longer.”

There’s a lot to unpack in that brief quote. First, that tenant turnovers are deadly to your returns. Why? Because they’re where most of the work and costs of rental management hit you. Doing move-out inspections, cleaning up the property, repainting, maintenance and painting, advertising the unit, carrying the mortgage, showing the unit, collecting rental applications, running tenant screening reports, signing a lease agreement, doing a move-in inspection… whew.

That’s a far cry from sitting back and watching the rent direct deposited in your bank account every month.

Also, if the quality of your tenants determine your returns, then tenant screening is the most important landlording activity you undertake. Don’t rush through it. It’s the meat of what it means to be a landlord, not an annoying distraction.

Finally, be wary of low-end neighborhoods and Section 8 tenants, despite how the numbers sometimes look on paper or on a rental income calculator. Often they come with hidden headaches and costs not seen with mid-range and higher-end rentals.

Small Gestures of Appreciation Go a Long Way with Your Tenants

Here’s a quick story from Dominick Tiziano of AccidentalRental to illustrate this point: “It’s amazing how far an unexpected gift will go to create goodwill with a tenant.

“I had a tankless water heater go out on a Friday night and couldn’t get a technician to look at it until Monday. The tenant was able to shower at the gym and get by but was anxious about getting it fixed ASAP.

“I had a tankless water heater go out on a Friday night and couldn’t get a technician to look at it until Monday. The tenant was able to shower at the gym and get by but was anxious about getting it fixed ASAP.

“After the water heater was fixed, I followed up with the tenant thanking them for their patience and sending them an Amazon gift card for their troubles. They were surprised and delighted because they weren’t expecting anything.

“I never had any other complaints or issues with that tenant.

“The lesson I learned was that it pays to be fair and show your tenants that you understand when they have been inconvenienced.”

Part of learning real estate investing and landlording is learning when to be generous with tenants. When it comes to enforcing your lease agreement’s rules, be uncompromising. But when they’ve been inconvenienced, even when it’s “not your fault,” find ways of showing that you appreciate their understanding – and appreciate them as clients, which they are.

(article continues below)

Batch Your Showings of Vacant Rental Units

Showing vacant units takes time and effort. All too often, prospective tenants blow you off, after you’ve taken time out of your day to drive to the property to meet them there.

So? Don’t show it to specific individuals. Chris Siamof, Broker Associate with Keller Williams in Wisconsin’s Fox Cities, learned “the importance of setting up a ‘group time’ on my schedule to show prospective tenants. In the past I had set up individual showings and too often I would be stood up.”

So? Don’t show it to specific individuals. Chris Siamof, Broker Associate with Keller Williams in Wisconsin’s Fox Cities, learned “the importance of setting up a ‘group time’ on my schedule to show prospective tenants. In the past I had set up individual showings and too often I would be stood up.”

She goes on to reiterate tenant screening as the most important part of being a landlord. “In screening tenants I learned how valuable conducting a background search is. It is better to lose a month or two of rent than to inherit a poor tenant. A tenant sneaking in animals or falsifying work history can cost you thousands.”

Renovations & Selling

Tenants and sellers aren’t the only people that real estate investors need to work with. Part of learning real estate investing involves learning how to work with contractors, and knowing when to sell and when to hold.

Learn to Fire Contractors Quickly

Contractors are either reliable or they’re not. They either show up every day and do good work, staying on-schedule and in-budget, or they burble excuses at you and assume you’ll accept them.

What they won’t do is change their habits, and magically become more reliable or higher-skill. Jerryll Noorden explains why it’s so important – and so difficult – for new real estate investors to learn: “It is hard to fire a contractor, especially when they are knee-deep in the rehab. If you fire them you have to start over. Good luck finding a contractor willing to take over someone else’s work.

“Still if you do not, things will not simply get back on track just because you wish it so.

“Fire unreliable contractors, cut your losses, and move on.”

It’s not convenient. It’s not cheap. It downright sucks. But what sucks more is waffling and having them continue to do bad work, go over-budget, and blow your timetable.

Know How to Minimize Your Taxes

“If I would have fully understood how strong returns were after taxes, I would have invested more in real estate, and less in other asset classes, such as the stock market.”

Doug Brien, CEO of Mynd Property Management, explains how he’s found real estate vs. stocks. “The stock market can be extremely volatile, and has been volatile for nearly three decades. On the other hand, housing returns have remained strong and steady, while producing similar returns to S&P 500 stocks.

Doug Brien, CEO of Mynd Property Management, explains how he’s found real estate vs. stocks. “The stock market can be extremely volatile, and has been volatile for nearly three decades. On the other hand, housing returns have remained strong and steady, while producing similar returns to S&P 500 stocks.

“I learned that you can secure incredible tax breaks by investing in real estate through 1031 exchanges. These like-kind exchanges are one of the best ways to invest in real estate, but they have very strict timelines that an investor must follow. A 1031 exchange allows an investor to defer their capital gain from the sale of real estate just by trading it for another property. It’s one of the most effective ways to build wealth through real estate investing, while deferring taxes. In essence, an investor could keep ‘trading up’ into a better asset or assets over the course of a lifetime. When I first started investing, having a tax attorney or tax professional with 1031 exchange expertise would have been incredibly beneficial.

“I also learned that there are great tax breaks associated with investment property ownership. An investor can deduct their mortgage interest, property tax, operating expenses, depreciation and even repairs. In fact, just about anything related to managing investment properties is a tax write-off, from advertising your units when they become vacant, to maintenance, utilities and insurance. Landlord tax deductions even include the cost of travel for visiting their rental property.”

Know Your Exit Strategies and Stick to Them

It’s a common enough refrain as you learn about real estate investing: have an exit strategy. In fact, have several contingency exit strategies in place, behind your primary strategy.

If your planned exit strategy is to flip a house, what can you do if it fails to sell? Could you offer seller financing? Keep it as a long-term rental property? Use it as a vacation rental on Airbnb?

If your plan is to buy and hold the property as a rental, it’s just as important to consider what conditions would lead you to sell the property. Nichole Stohler was tempted by an offer, and justified taking it by telling herself she’d do a 1031 exchange and parlay the gains into an even better property. “Think twice before selling a property that is running smoothly and performing. Yes, that unsolicited offer is tempting but do you have the right exit strategy – in the current market?

“We had a 50-unit that was such a great property and we’d developed a strong on-site manager when we received an unsolicited offer to sell. After turning down the seller’s offer twice, we couldn’t resist. But then we couldn’t find another multi-family that met our criteria within the 1031 exchange deadline.

“We pivoted to a major branded hotel which is more seasonal with a unique set of nuances outside of our background… thus, we are learning all over again. Given the chance to go back in time, we wouldn’t have sold that 50-unit property. Beware the 1031 treadmill!”

Final Word

Learning how to invest in real estate takes time. It’s not something you can do casually, like buying an index fund to buy stocks.

It takes work to find deals, work to learn the ropes, work to learn how to manage rental properties.

So why does anyone bother doing it? Because people who take the trouble to learn real estate investing can earn outsize returns, and build real wealth quickly.

Don’t go into real estate investing lightly. Either commit to learn about real estate investing, or keep it on the back burner as you gradually explore it, but don’t buy your first investment property without first putting in your time on education.

Related Article Read : How to avoid capital gains tax on property?

Read about investment property loans with low down payment.

Brian – Excellent article with a wealth of advice! Thanks for including Accidental Rental!

Thanks for contributing expertise Domenick!

Brian, two thumbs up for a great compilation of advice and experience! One thing I want to add is that one “bad” tenant whether in a duplex or a 100-unit complex will spoil the

entire barrel. Screening is important! Thanks!

Great article with a ton of helpful information. Thanks for such wonderful, shareable content!!

Thanks Jenn! We try 🙂

Please don’t hesitate to let us know how we can help you learn real estate investing and build your rental property portfolio!

Great article! Super helpful to see what mistakes other people have made, so I don’t have to make them myself 😉

Thanks Jacob! Definition of wisdom over intelligence!

Thanks a lot for sharing this resourceful article! I will remember your points.

Thanks for the comment Jeff!

Thank you for the encouragement to learn and invest in real estate. Have a prosperous year!

Thanks Jack, have a great year yourself!