Two-thirds of American homeowners take out a mortgage when they buy their home, and even more investors use real estate leverage (other people’s money) to expand their portfolio.

Are they wrong to do so?

Not necessarily, although some people borrow more than they should. You may not even want to pay off your mortgage(s) faster; after all, some mortgage debt is downright cheap. If your home mortgage costs you 3.5% interest, and you can earn a return of 8% from the stock market (or 18% buying a new rental property!), maybe that leverage makes perfect sense.

Even rental property loans tend to cost less in interest than average stock market returns. Check out Credible.com* to compare prequalified rates on conventional loans, and Visio, Kiavi, and LendingOne as direct portfolio lenders for rental property loans.

But the logic of real estate leverage only works if you’re actually putting aside a big chunk of your income and putting it to work somewhere. With the average savings rate hovering below 5% in America, most people are just paying their minimum mortgage payment and then spending the rest.

Let’s assume that you’re sick and tired of paying interest to banks. Paying off your mortgage(s) is a guaranteed return on investment, which can’t be said for investing in the stock market, or even for real estate investments (more on real estate vs. stocks here).

So how can you ditch your mortgage debt faster? Here are four strategies to pay off your mortgage quickly… enjoy!

1. Several Techniques to Pay Extra

First and foremost, call your lender, and ask about any prepayment restrictions. Some banks are persnickety, even about taking your money.

Biweekly Payments: One option that’s painless is to call your lender and arrange biweekly payments. Every two weeks, you pay half of your regular mortgage payment.

This has two advantages: first, it mimics your paycheck cycle. If you get paid biweekly, you can have your mortgage payments deducted on the same day you get paid. Bada bing, bada boom, no budgeting necessary (at least for your mortgage payments).

Second, you’ll end up making an extra mortgage payment every year, since you’ll be making 26 half-month payments, rather than 12 one-month payments. Painless!

Round Up: No “cute” tricks here, just good ol’ fashioned round numbers. Round up to the nearest hundred, or to the nearest five hundred if you’re feeling more ambitious.

Raise Up: When you get a raise, add the entire raise amount to your mortgage payment. That’s one way to battle lifestyle inflation!

2. Refinance (or Don’t and Say You Did)

Refinancing comes with plenty of drawbacks, and only makes sense in very specific circumstances. But if you drop your 30-year mortgage to a 15-year mortgage, relatively early in your original loan, for a substantially lower interest rate… all right, I agree, it might make sense.

If you have an adjustable rate mortgage (ARM), and your interest rate skyrockets, that’s another scenario where it makes sense to refinance for a lower, fixed interest rate.

You could even pull some cash out to pick up your next investment property, while you’re at it. But I digress – this is supposed to be about reducing debt, not adding more!

Beware though: in addition to all those extra closing costs, refinancing starts your amortization schedule all over again. That means a higher percentage of your monthly payments go toward interest rather than principal. If you’re three years into a 30-year mortgage and refinance to a 15-year mortgage, that may make sense, because you’re accelerating your amortization schedule anyway. But if you’re already ten years into the mortgage, consider just pretending to refinance.

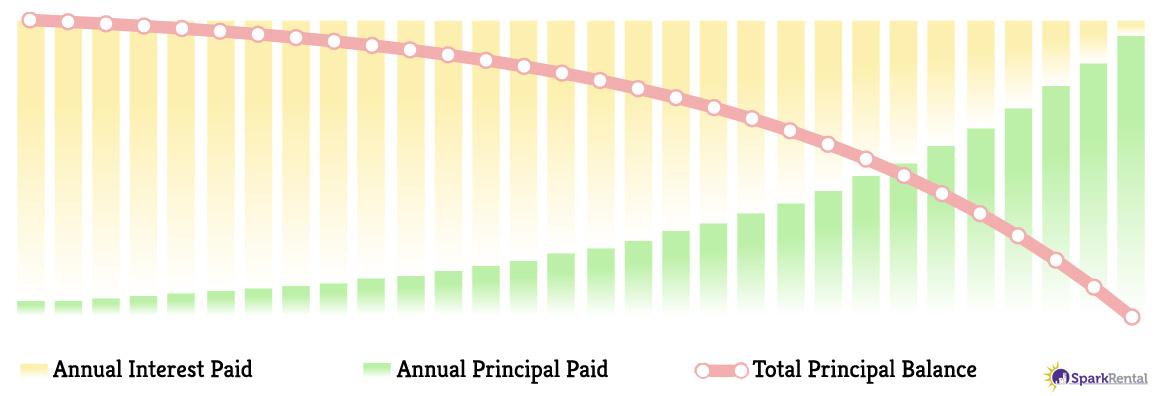

Here’s how interest amortization looks, showing how lenders charge more interest in the beginning of your loan term:

See why lenders are so keen to keep refinancing you, and not let you reach the end of your loan term?

Use a mortgage calculator (there’s one built into our rental cash flow calculator) and look up what your mortgage payment would be if you refinanced to a 15-year loan. Then just start making those higher payments! You still accelerate your amortization schedule, and you don’t have to line some punk loan officer’s pockets by paying a bunch of new lender fees and closing costs.

3. Push Hard to Remove PMI, then Keep Making The Full Payment

Most conforming lenders allow you to petition to have private mortgage insurance (PMI) removed when the loan balance drops below 80% of the property’s value. Hopefully, your property’s value has gone up, even as you’ve paid down your mortgage, so you may not have to wait too long (especially if you scored a good deal).

But why sit around waiting? Make change happen! Every time you get an unexpected windfall, throw it at your mortgage. Got a tax refund? Pay down the mortgage. Got a bonus at work? Pay down the mortgage. Got cash as a gift? Pay down the mortgage.

Call your lender and double check their procedures for removing PMI, and keep an eye on property values in your neighborhood. Be prepared to pounce when you’ve hit that golden 20% equity level!

When your lender does (finally) remove the PMI from your payment, keep making the original payment. The portion of your payment that had been going to PMI will now pay down your principal balance faster, helping you leap forward in your amortization schedule. You’ll quickly skip some of the early, high-interest proportions in your monthly payments, and exponentially speed up your loan term.

4. Sell Off Another Property

Have some equity in another rental property? For that matter, maybe you have equity in your home, and don’t need such a large or extravagant home?

You could always sell the property, and with the windfall of money pay off another property’s mortgage.

There’s a case to be made that it’s better to have five properties that each cashflow $1,200/month than fifteen properties that each cashflow $400/month. Managing more properties comes with more headaches, bookkeeping, accounting, labor, etc., so why not own fewer properties with better cash flow?

Except, of course, that over time your rental properties do tend to appreciate in value. And eventually, you’ll pay off those mortgages, leaving you with dramatically higher real estate cash flow.

Is There Such a Thing as Good Debt?

All right, that was a rhetorical question. We all know there is.

But “good debt” is uncommon, and narrowly defined. Good debt is any debt that directly helps you earn more money – for example, taking on mortgage debt for a rental property that will generate cashflow.

Even so, debt comes with other strings. It’s easy to over-leverage yourself without realizing it. Having ten rental properties, each mortgaged to the hilt, might work out when all of them are occupied, but what happens when three of them become vacant at the same time by chance? And each of the three needs $4,000 in turnover costs? And another property needs a new roof for $5,000 at the same time?

Over-leveraging aside, there’s a certain psychological freedom that comes with having no – or minimal – debts. It may be less tangible, but the feeling of possibility and positive growth that comes with debt-free investing is powerful nonetheless.

I’m not saying you should never borrow money to buy rental properties. It often makes perfect sense to do so. But take some time to consider whether now might be a good time to start reducing your existing debts.

Don’t forget, paying off debt is a guaranteed return on investment!

How much debt do you take on in your rental investing? Have you had success paying off mortgages early? Spill the beans below, and if you enjoyed this article, share it with other real estate- and personal finance-minded friends!

More Crossroads of Real Estate & Personal Finance

*Credible Disclosure: Prequalified rates are based on the information you provide and a soft credit inquiry. Receiving prequalified rates does not guarantee that the Lender will extend you an offer of credit. You are not yet approved for a loan or a specific rate. All credit decisions, including loan approval, if any, are determined by Lenders, in their sole discretion. Rates and terms are subject to change without notice. Rates from Lenders may differ from prequalified rates due to factors which may include, but are not limited to: (i) changes in your personal credit circumstances; (ii) additional information in your hard credit pull and/or additional information you provide (or are unable to provide) to the Lender during the underwriting process; and/or (iii) changes in APRs (e.g., an increase in the rate index between the time of prequalification and the time of application or loan closing. (Or, if the loan option is a variable rate loan, then the interest rate index used to set the APR is subject to increases or decreases at any time). Lenders reserve the right to change or withdraw the prequalified rates at any time.

Credible Operations, Inc. NMLS# 1681276, “Credible.” Not available in all states. www.nmlsconsumeraccess.org.

About the Author

G. Brian Davis is a real estate investor and cofounder of SparkRental who spends 10 months of the year in South America. His mission: to help 5,000 people reach financial independence with passive income from real estate. If you want to be one of them, join Brian and Deni for a free class on How to Earn 15-25% on Fractional Real Estate Investments.

I can’t wait to have my mortgages paid off. I only have three, one on my home, and one on each of my two rental properties. I’m going to try putting a certain amount of extra money toward my one rental property loan, and when it’s paid off, I’ll put the same amount PLUS the saved amount from the paid mortgage, toward my other rental’s mortgage. Not sure how my next rental fits in: I want five before retiring, all paid in full. Excited to get there!

That’s a great strategy Hank! Snowballing your debt payments creates exponential reduction in your debt balances. Keep us posted on your progress, and I especially want to hear about how you decide to handle buying new rentals vs. paying down your mortgage debts.

Fun article! For me anyway. I love this stuff. I’m going to start with the biweekly payment strategy, and pay extra as I can every two weeks. Going to try to get rid of my PMI and then really start working on my principal balance!

Haha, well I love this stuff too. Obviously 🙂

Yeah a lot of these strategies can be mixed and matched, as you pointed out. Best of luck on knocking out your mortgage debts!

I’m going to try to get my husband on board with paying these mortgages down faster. He likes his designer clothes, tough to rein in his spending!

We sold our larger home to buy and move into our rental property. We paid it off within a year and now live in our forever home with a paid in full rental property. What would be our next step to purchase our second rental property?

Hi Blair, there are several next steps. First, maximize your savings rate. Set aside as much money as possible to serve as a down payment. Next, expand your financing toolbox. Get a sense for the down payment amount you’ll need, and form a plan to assemble that money. In addition to your savings, consider rotating business credit lines and cards – see our Investment Property Loans page for more info on options.