Beaten by a cash offer on your last real estate offer to purchase? You’re not alone.

The percentage of cash offers in real estate markets across the country have surged to 25% per the National Association of Realtors, up from just 15% a year ago.

Still, you don’t need to make a cash real estate offer to win a purchase contract. As in all negotiations, the secret is simply that not all sellers all motivated by the same thing. Here’s how to level the playing field and beat out all-cash offers in real estate investing.

Appeal to Each Seller’s Motivation

Savvy buyers know that each seller has unique needs, unique motivations. The trick is to identify what motivates each seller before you make a real estate offer.

You can ask directly of course, or have your Realtor ask the listing agent. Maybe they will come out and tell you in hopes of getting the deal done. But since most sellers are motivated by one or more of the same few factors, often it’s easier to indirectly inquire about those factors.

Not all sellers are created equal. By understanding what the seller wants more than anything, you can tailor your real estate offer to purchase so that it speaks to their personal needs.

Below are the most common seller motivators and how to work within them to appeal and persuade the seller to take your offer, rather than an all-cash buyer.

Motivator: Speed

Some sellers want their property sold yesterday.

They might not come right out and say it to avoid looking desperate, but some sellers need to move quickly. It’s a source of anxiety for them. Perhaps a new job awaits them, and they need to close to relocate and buy a new home to avoid moving the family twice. Or maybe they need the money quick for another investment opportunity.

Or, most motivating of all, they’re in financial distress and need money pronto. Whether they’re in foreclosure, in tax sale, getting a divorce, or have some other lien hanging over them, some sellers will take the fastest closing they can get — even if it means a lower sales price.

You can find distressed sellers through services like Propstream or Foreclosure.com:

Purchase Offer Tactics:

- Make your money easy to access. No one is disputing you have the funds. However, it is naive to assume you can move large amounts of money around instantly, especially if it’s currently invested in stocks or other non-liquid assets. Designate or create an account for your down payment and other funds to expedite this part of the process.

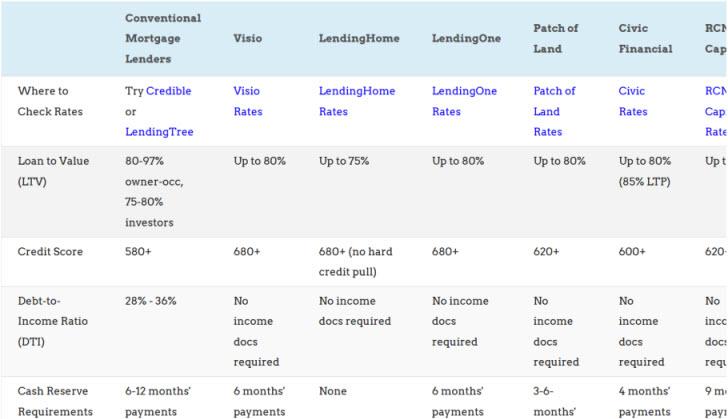

- Engage your lender before you start. Start all the financing processes before you start the search. Get pre-approved by your investment property lender, to reassure the seller that you can and will settle quickly and certainly.

- Expedite the appraisal process. Talk with your lender, pre-schedule the appraisal if you can, or maybe you can avoid this altogether with a large enough down payment.

- Limit inspections work. Leaky faucets, new light bulbs, a crack in the wall – all of these things can be easily fixed once you take possession. Ensure the property is structurally sound, but don’t waste time and patience sweating the small stuff.

- Don’t be afraid to negotiate. It starts with simply opening a back-and-forth dialogue with sellers. Once you start a real estate negotiation, you can better feel out exactly what it is the seller wants. Try these real estate negotiation tactics to score the best possible deal.

Related Article Read: Best Ways To Find Pre-Foreclosure Listings.

Related Article Read: What is driving for dollars.

Motivator: Credibility that You Can Settle

Sellers may want to go with a more relatable buyer, but the assurance of working with a corporate investor is hard to pass up. That goes doubly when they make a real estate cash offer. You may be offering more money and expedited settlement, and still the seller remains hesitant. At that point, it may be time to employ other tactics to increase your credibility.Real Estate Offer Tactics:

- Partner with another investor. A mentor, a family friend, someone you met networking for real estate investing. Approach them a strike a deal that works for both of you and allows you to use their name or business for credibility.

- Present yourself. Similar to sharing your financial situation, give the information a complete picture of who you are. Family, job, credit score, income, bank statements. Share anything about you that will help make your case.

Motivator: Flexibility

Find out everything you can about the seller’s situation. They could want to sell the home but live in it for a while longer. They could be renting out the home and want to sell it, but allow their tenants to renew their lease agreement and stay. Whatever the motivator is, identifying it and working with them can make all the difference.Offer Tactics:

- Let the seller choose the closing date. While it may be more of a gesture, it indicates to the seller you are amenable to their needs.

- Tell them you are open to arrangements for possession date. Communicate either directly or through your Realtors that you are flexible on possession, and they can stay and rent the property as long as they like.

- Offer to accommodate their renters, if that remains a sticking point.

Motivator: Personal Politics

Some people simply abhor the idea of selling to someone who is going to modify or use their home differently than they did. In some cases, they would even pass on increased selling price to do so. I once saw a soon-to-be-married bachelor sell his bachelor pad for a lower sales price, specifically because the buyer was another bachelor who reminded him of his former self, and had expressed interest in continuing the party tradition of the house. Families do this all the time as well, preferring to sell to other families. In short, sellers don’t always make their decisions rationally. It often comes down to a sense of personal connection and continuity.Real Estate Offer Tactics:

- Write them a letter. Often called a “love letter,” these letters explain your situation and appeal to the seller on a human level that is absent when dealing with corporate investors.

- Ask to meet face to face. Sometimes cutting out all the middlemen, paperwork, and negotiating and grabbing a coffee can help you present yourself to the seller and make your case. Don’t do this without notifying your real estate agent, if you’re working with one.

Motivator: Money

Money is always a motivator in some form or another. Many buyers have seen their neighbors’ homes sell for big bucks, and they start seeing dollar signs. If money is a primary motivator for your seller, be prepared to offer more than a cash buyer to level the playing field.Purchase Offer Appeal Strategies:

- Share your financial situation; credit score, cash reserves, debt to equity, and employment status.

- Put down at least 20%. Increasing your down payment increases the probability that your financing will get approved smoothly. Many things can go awry, such as appraisals coming in lower than expected, but this helps mitigate that risk.

(article continues below)

Getting Creative with Your Offers

If these tactics don’t work, what else can you try?

Think outside the box. If you have tried these methods and they haven’t worked, it could be time to switch things up. Maybe you have come close, maybe you haven’t, or maybe it doesn’t feel like you have made any progress. Real estate investing is a competitive field, and a numbers game requiring many offers before one goes through successfully.

To close the deal, it might be time to starting thinking outside of the box and consider the following:

Find Off-Market Properties

One way to decrease the competition is to find opportunities on your own. This is a tried and true method of established real estate investors. Consider these to get you going:

- Networking: Real estate meet-ups, common connections, chat boards, and LinkedIn. Getting out and talking to people about finding good opportunities can only increase your odds.

- Direct Mail: An old school method. Finding areas or homes and writing letters to the owners appealing to them or asking if they are interested in selling can create interest. But this works particularly well when you identify high-equity homes with urgent sellers, using a platform like Propstream (see our full Propstream review here) or Foreclosure.com. Another great tool for “driving for dollars” is DealMachine: you simply take a photo of the home with the app and it spits out the home’s equity, sale history, mortgage balance, and owner contact information. You can even click a button to have DealMachine send your direct mailer for you!

- Spread the Word: Start telling people you’re looking for off-market real estate deals. The more people you tell, the better your odds are of finding something off-market.

Avoid Investor-Soaked Markets

Wealthy, coastal cities tend to have a higher density of real estate investors than rural and smaller markets. Go where the competition isn’t.

- Do Your Research: Create your own metrics. Look to places where opportunities might exist soon. Visit these locations, talk to residents, and get a feel for the area(s). Try these best cities for real estate investing by cap rates for some fresh ideas.

- Identify Investor Areas: Investors tend to focus on neighborhoods and markets with high cap rates. Being active in a market, looking up data, and talking to real estate agents can confirm your suspicions about where investors are starting to look for deals.

- Consider Buying Long-Distance: Your home market may be saturated by investors and offer poor returns, but you can always invest elsewhere. One option for buying long-distance is Roofstock, where you can browse turnkey properties and view detailed neighborhood analytics and property details from appreciation history to forecasts to home inspection reports. They even offer a 30-day money back guarantee!

Be Persistent & Disciplined

It may take dozens or even hundreds of offers before one settles!

- Avoid Emotions: Whether you’re planning to live in the house, flip it, or rent it, it is difficult not to get worked up, discouraged, or in a position to make a poor decision.

- Play the Numbers Game: Cash buyers don’t always get their offers accepted, and being a financed buyer doesn’t mean your offer won’t get accepted. Play the game enough times and create enough opportunities for yourself until you close.

- Don’t Give Up: Easier said than done, we know… But the truth is there are many stories of aspiring real estate investors who gave up to soon. Follow the strategies and don’t let yourself be one of them.

Final Word

Sure, cash real estate offers are compelling. But that doesn’t mean you can’t compete with them and win, when you’re financing your purchase.

Learn as much information as you can about each seller, and what motivates them. Every seller is different, and while one may want nothing more than an immediate sale, another may prefer the flexibility of renting the property after selling, as they await their new home purchase.

Most of all, remember it’s a numbers game. Keep making offers, keep negotiating, and eventually one of your deals will go through. Your success is inevitable – if you remain patient and disciplined.

Related Article Read: Everything you need to know about due diligence in real estate.

Related Article Read: Should I Transfer the Title on My Rental Property to an LLC?

What tactics have worked for you when making real estate offers to purchase? How have you competed with real estate cash offers?

Great article! There are some really good ideas and tactics. Being flexible is a great one, especially when it comes to inspection time. That could put you above the rest for sure.

Thanks Don, glad to hear it was useful for you!

Hi Brian, I just wanted to say how great your blog is. I have been following along for a while and love the content. I share it often!!

Thanks Heather, very much appreciated!

It sure is difficult to compete against cash buyers, but I appreciate the ideas to overcome that.

Thanks Daniel!

Cash buyers always have an advantage. But that doesn’t mean you can never score a good deal with a financed offer. Some good tips.

Thanks Hivara!

Way to go Brian. Always come up with amazing blogs. Keep going, brother.

Thanks Oslo!

A very fierce competition. Cash buyers always have the upper hand. Good to know how to compete with them.

Glad it was useful Baiq!

For real estate investors who can deliver great offers to sellers, money is only paper. Cash is inevitably compelling but an offer beyond the price tag is a diamond! Skills on this blog is what we, investors, should hone. What a good read. Happy trails!

For me, PR is the greatest asset to win real estate offers. Cash offers is just secondary. I like what the article says, be creative with your offers. Think outside the box!

Cheers Prince!