The Big Picture On How Much You Need To Retire Early:

-

- Retiring early is difficult, but very possible. It takes knowledge and discipline to achieve.

- There are several strategies that you can use to figure out how much money you need to retire early. These depend on your lifestyle, earnings, and other factors.

- Combine different income streams to grow your nest egg over time.

Disclaimer

The information provided on this website is for general informational purposes only and should not be construed as legal, financial, or investment advice.

Always consult a licensed real estate consultant and/or financial advisor about your investment decisions.

Real estate investing involves risks; past performance does not indicate future results. We make no representations or warranties about the accuracy or reliability of the information provided.

Our articles may have affiliate links. If you click on an affiliate link, the affiliate may compensate our website at no cost to you. You can view our Privacy Policy here for more information.

Why don’t more people dream of retiring young?

It could speak to how many people love their jobs, except that’s not true: 85% of people dislike their jobs. More likely, most people just don’t think they can retire young.

Fortunately, anyone earning the median U.S. income can retire young if they want. But it requires discipline — not many people want to forgo things like driving the fanciest car possible or living in the best house they can afford.

“Yeah yeah yeah, cut to the chase already! How much money does it actually take to retire young?”

Glad you asked.

Common Strategies To Retire Early

If you’re reading this, I’m sure you’ve already looked into some of the more common strategies to enhance your chances of retiring early. But, here’s a quick recap:

| Strategy | Description |

|---|---|

| Save Aggressively | Aim to save a significant portion of income (e.g., 50-70%) to accelerate retirement savings. |

| Invest Wisely | Invest in a diverse mix of assets to grow wealth over time, focusing on stocks, bonds, and real estate. |

| Reduce Expenses | Minimize living costs by cutting unnecessary expenses, which can increase the rate of savings. |

| Increase Income | Explore ways to boost income through side jobs, promotions, or new career opportunities. |

| Plan for Healthcare | Secure healthcare options before Medicare eligibility to cover potential medical expenses. |

| Tax Optimization | Use tax-advantaged accounts like Roth IRAs and 401(k)s to save for retirement efficiently. |

| Early Withdrawal Strategies | Implement strategies to access retirement funds without penalties, such as the Rule of 72(t). |

Now, let’s take a look at safe withdrawal rates and how rental income changes the math on how much you need to retire early.

Safe Withdrawal Rates

In traditional retirement planning, you decide how much income you want each year. Note that your target retirement income is not connected to your current annual salary. You can and should live on far less than your current income, maintaining a high savings rate to reach your financial goals faster.

Once you know how much income you want in retirement, decide on a withdrawal rate: the percentage of your nest egg that you pull out every year to live on.

The classic safe withdrawal rate is 4% — so classic that the “4% Rule” remains a rule of thumb for retirement planning. If you want $40,000 in annual retirement income, you would therefore need a retirement nest egg of $1 million (4% of $1 million is $40,000).

You can expect your money to last for at least 30 years, with a 4% withdrawal rate. If you want to retire young, use a 3.5% withdrawal rate to preserve your nest egg indefinitely. If you only need your retirement savings to last 20 years, you can potentially pull out 5% or more each year.

Here’s a withdrawal rate calculator for planning how much you need to retire:

How Rental Properties Change the Math for Early Retirement

Say Heidi invested $50,000 apiece into four rental properties ($200,000 total investment). They rent for $1,000 apiece, and after subtracting out property taxes, landlord insurance, vacancy rates, maintenance, and CapEx, Heidi is left with $500 apiece in monthly income. That’s $2,000/month total from the three properties or $24,000/year in income from her rental properties.

Wait a second — Heidi just made over half her annual budget, but it cost her a fraction of what she would need if she invested in stocks. She invested $200,000 in rental properties, covering $24,000 of her $40,000 annual budget! The math just changed dramatically.

The remaining nest egg (in her stock portfolio) only needs to provide the $14,000 difference. According to the 4% Rule for retirement, to safely withdraw $14,000/year, she needs a stock portfolio of $350,000. But since she’s retiring young, she opts for a 3.5% safe withdrawal rate, which means she’ll need $400,000 in stocks to produce $14,000/year.

That puts her at $200,000 in rental properties and $400,000 in stocks, for a total of $600,000 invested to produce $40,000/year in income. Not a trivial amount of money, but because she invested in rental properties, she dropped her required nest egg from $1,142,857 to $600,000.

That’s nearly half as much as she’d have needed in stocks alone. Hot diggity dog! (Heidi can use 1940s expressions because she’s now a proud retiree.)

But she could actually achieve financial independence with even less money, if she uses real estate leverage.

Leverage Changes the Math Even More

Heidi doesn’t want to pay cash for her properties. She buys them with rental property loans, at 80% LTV financing (in other words, with a 20% down payment).

Instead of buying four rental properties for $200,000 in cash, she buys four $250,000 properties by taking out loans. She makes a $50,000 down payment on each property.

Each property generates $1,250/month in net revenue, minus $630 for the mortgage, for a net monthly cash flow of $620/property. For all four properties, that comes to around $2,500/month, or around $30,000 a year.

Heidi cut her cash investment in half and now generates three-quarters of her annual revenue from rentals!

That leaves only $10,000/year of income she needs from her stocks. Following a 3.5% withdrawal rate comes to $286,000 in stocks.

Wait a second, Brian! It’s hard to find deals that cash flow that well!

Yes, it is. But even if your rental property cash flow isn’t as strong as Heidi’s, you can still find rental properties that generate ongoing income better than stocks do. Try these tactics to find good deals on rental properties, even in hot markets, coupled with these real estate negotiation techniques.

The BRRRR Method: Recycle the Same Down Payment

To accelerate your rental portfolio even faster, use the BRRRR method of real estate investing. The acronym stands for buy, renovate, rent, refinance, repeat; think of it as flipping homes, except instead of selling after renovating, you refinance and keep the property as a rental.

The beauty of the BRRRR method is that you can pull your original rental property down payment back out when you refinance. Thus, you end up financing 100% of your real estate investing costs.

You can then recycle the same funds over and over again, adding to your portfolio and passive income with each property. It’s the fastest and lowest-cash strategy I know for retiring with real estate; it doesn’t just bend the 4% Rule; it throws it out entirely because your income in retirement suddenly has no connection whatsoever to how much cash you started with.

Makes saving for retirement a bit easier, eh?

Real estate investors sometimes refer to this model as “infinite returns.” You get your money back, but you keep the property. There’s no limit to the returns you can earn on your investment capital, when you can keep recycling it to add more properties to your portfolio.

As powerful as it is, just be careful that your properties still cash flow well after refinancing to pull your money back out. Use extremely conservative numbers when you run the numbers in a rental income calculator.

Infinite Returns on Passive Real Estate Investments

Love the idea of infinite returns, but hate the idea of becoming a landlord?

Learn how to invest passively in real estate.

Real estate syndications often target infinite returns, with the syndicator refinancing to return passive investors’ money. After the refinance, you get your money back as a silent partner, but you keep your ownership interest in the property.

Renovating and refinancing a 200-unit apartment complex takes longer than a single-family rental property. Think two or three years instead of two or three months. But you don’t have to take on any of the headaches of finding properties or renovating them, messing with lenders or contractors or tenants.

The principle works just like the BRRRR method: you get your investment capital back and can reinvest it, even as you keep earning cash flow from the prior investment.

Real Estate vs. Stocks for Retirement Income

So wait, why doesn’t Heidi buy only rental investments for her retirement income, then?

Diversity, for one reason. Do you really want all your financial eggs in one basket when the entire income for the rest of your life is on the line?

And if we’re being honest, rental properties are not 100% passive income — they require some work, even with the best landlord software available (cough).

Diversifying your assets also gives you multiple options for withdrawing funds. When Heidi’s stock portfolio has a bad year, she can avoid selling stocks by drawing more money from her rentals. She can postpone repairs and offer incentives to retain tenants who are thinking about moving to reduce turnovers.

Like stocks, Heidi’s rental investments may have a bad year, perhaps caused by vacancies or high repair costs. Or they may have had a great year with no repairs or vacancies. The important thing is that she’s properly calculated her average costs.

With her diverse investment strategy, Heidi can simply draw more money from her stock portfolio. In good years, she can even invest more money in her stocks!

Heidi can also invest in bonds to add stability to her portfolio, but keep in mind that bonds suffer from inflation losses. If the inflation rate runs hot at 4%, and her Treasury bonds pay only 3%, she actually loses 1% each year. Rental properties don’t have that problem since rents rise alongside inflation (more on hedging against inflation here). It’s why I replace bonds with real estate in my own portfolio, which says nothing of the higher annual returns you can earn on real estate.

For a better grip on how real estate and stocks counterbalance each other well, read this breakdown of real estate vs. stocks for retirement income.

Staying Flexible with Retirement “Lifeboat Strategies”

When you retire young, you have a long retirement ahead, and anything could happen.

You may find that you spend more money than you expected in retirement. With so much free time, you may want to travel more or spend more on entertainment. And then there’s healthcare in retirement, which can be expensive without employer-sponsored health insurance plans.

Young retirees should look for ways to keep their spending and incomes flexible. Why not work part-time doing something fun? Or, for that matter, work full-time at a job you find fulfilling and meaningful?

Young retirees should look for ways to keep their spending and incomes flexible. Why not work part-time doing something fun? Or, for that matter, work full-time at a job you find fulfilling and meaningful?

You could do freelance work, offer coaching and mentoring, consult for growing companies, or start a business! In addition to my rental income, having launched SparkRental with Deni, I do some freelance writing for fun and to invest more. My mother tutors for extra income for investing and travel.

Many of these flexible jobs allow you to live anywhere, too. You could earn money flexibly even as you save money on alternative housing and travel the world!

You can also reduce your spending through house hacking. But if you want to reach financial independence and retire young, be prepared to get creative in reducing your spending and maximizing your income and investments.

How Much Money Do You Need to Retire: 2024 Sample Numbers

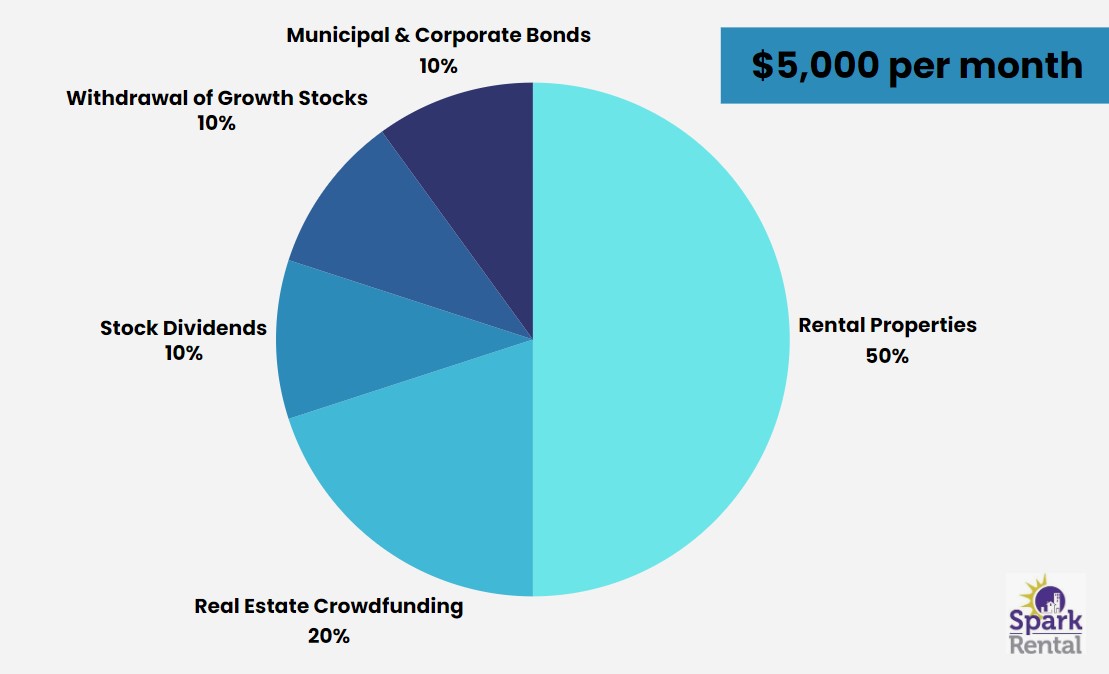

Imagine you want to retire on $5,000 per month or a $60,000 annual income. Here’s how you might go about combining several sources of income:

| Investment Type | Monthly Income | Capital Required | Return or Withdrawal Rate |

|---|---|---|---|

| Rental Properties | $2,500 | $50,000* | BRRRR strategy recycling |

| Real Estate Crowdfunding | $1,000 | $150,000 | 8% annual return |

| Stock Dividends | $500 | $133,333 | 4.5% dividend yield |

| Withdrawal of Growth Stocks | $500 | $171,429 | 3.5% withdrawal rate |

| Municipal & Corporate Bonds | $500 | $120,000 | 5% rate of return |

That comes to a total of $624,429 invested. More, if you leave cash tied up in each rental property. But the point is that it doesn’t take millions of dollars to reach financial independence or early retirement.

You can add Social Security income as another stream once you reach the classic “retirement age” in your 60s. Your individual retirement account (IRA) or employer-sponsored retirement plan can help, too, once you reach 59 ½. But neither helps you retire early.

You can use an HSA as another tax-sheltered retirement account as well, with no age limits on withdrawals. However, it comes with lower annual contribution limits than traditional retirement accounts, and you can only use withdrawals to cover medical expenses.

Try out our free financial independence and early retirement calculator to run the numbers combining several income sources at different investment returns.

Common Problems Faced When Saving To Retire Early

I’ve made it plenty clear that retiring early is not going to be a walk in the park. The best way to maximize your chances of achieving your goal, is to know the common issues that you’ll be facing, and how to manage them.

| Challenge | Description | Mitigation Strategies |

|---|---|---|

| Sustaining Income | Ensuring enough savings for a longer non-working period. | Develop passive income streams and diversify investments. |

| Healthcare Costs | Managing high healthcare expenses before Medicare. | Invest in a robust health insurance plan or health savings account. |

| Lifestyle Adjustments | Adjusting to a fixed or lower income while maintaining lifestyle. | Create a realistic budget that prioritizes essential expenses. |

| Investment Risk | Higher risk due to a longer period the retirement fund must last. | Diversify investments and consider conservative allocation as age increases. |

| Social Security Benefits | Reduction in benefits from retiring early. | Plan financials assuming lower benefits and delay claiming if possible. |

| Inflation | Erosion of purchasing power over time. | Include investments with potential to outpace inflation, like stocks or real estate. |

| Loneliness and Boredom | Social and psychological challenges from retiring early. (Yes, it’s not all sunshine and rainbows.) | Stay socially active and engaged in community or hobbies. |

Final Thoughts

Real estate helps you break the 4% rule in retirement planning. You only have to worry about safe withdrawal rates for your paper assets like stocks and bonds — not your real estate assets that generate ongoing income.

Of course, real estate comes with its own risks. Before counting on real estate income in retirement, ensure you know how to mitigate risk as a landlord or investor. But by investing with real estate leverage, you can easily reach financial freedom young and perhaps even retire by 40!

As you set your own retirement goals, check out this case study of a woman who retired at 30, this woman who quit her day job in her 20s, or this man who quit his job within 18 months of starting to invest in land.♦

How much money do you need to retire? What mix of assets do you have planned for your retirement portfolio?

So important to keep the big picture in mind. The reason I invest in rental properties is so I can retire young, and to me this article isn’t just about the mechanics of the 4% Rule (although that’s fascinating too), but also about remembering why I’m doing this in the first place.

Very true Cassie – both the “why” and the “how” are critical, one alone won’t cut it!

The dream! Marching toward it slowly but surely…

Where can I find rental properties for $50k , sounds like science fiction!

Haha, I hear ya Aijamal! I’ve bought properties for (much) less in Baltimore City, though it’s worth noting that low-end properties can come with extra risks and complications for the landlord.

That does seem crazy cheap to most people, but it’s just depends where you buy. All my investment properties were purchased for around that price, many for much lower. They are in Montgomery, Alabama.

Like Brian said, you deal with more problems. I have higher turnover than I would in a more expensive area, but it’s not as bad as some would imagine.

Brian, this is a great overview of the benefits of rentals mixed with other assets! I like how you don’t make it an either or proposition. Every asset class has it’s benefits and drawbacks, and when you mix them you can take advantage of all of them.

I personally think rentals are a great FIRST focus when planning for retirement (especially an early one), because of their large income production. The primary downsides are potential time investment and large, unexpected capital expenses. But if you’re younger, you can handle those easier and adjust your lifestyle as needed during those tough times.

Once you have that base of rental income, then you can work on balancing and diversifying the rest of your portfolio (as you leisurely enjoy your life!).

Thanks Chad! I’m with you – I love rentals as a source of indefinite income. But as you mentioned, equities play an important role, and I love how they counterbalance a real estate portfolio. Loved your recent article on this topic as well!

I flip homes for a living. Purchasing a rental property may involve less fix up effort. It may require little cap ex fix ups as long as your tenants take reasonable care of the place. Have it cleaned and checked out after each rent.

Thanks for the review.. it’s simple.

Simple, but not always easy! But I agree it’s a great way to build retirement income.

If you take out the funds needed for future repairs and maintenance, as well as loss in occupancy on some possible months then doesn’t that take the majority of the major risk factor away?

Everyone makes it seem so hard and risky to invest in rental properties but I feel that if you put those funds away and don’t try to profit $1000 off the place then you will be just fine.

Am I correct or am I missing some major costs and headaches besides your mortgage, taxes, and insurance?

I never thought much about the long term consequence of having rental property, I kind of stumbled into it. Bought a 2 flat b/c I couldn’t afford a single family house. After living in 1 unit, renting the other, fixing the place up a bit, I looked and I had a bit of equity and a few kids so I bought another 2 flat in an area of the city with schools, parks and single family homes. Its another ten years later, I have 4 rental apartments and we live in one of them. Property values and rents have risen a bunch. I do most work on the places. rents pay @ $1500/ month after mortgage, tax, insurance and utilities. Is this $1500 in passive income or does the monthly equity part of my mortgage passive income too?

That’s great Mark! Glad to hear you’ve been able to build some passive income from these properties. As for the math, make sure you subtract out money for repairs, maintenance, vacancy rate, property management costs (labor costs, if you’re managing yourself), etc.

Thank you for sharing this information! Now I know how to maximize my retirement funds for my rentals.

Believe it or not, I mix NFT to my portfolio! It’s not the same as bonds, stocks, and rental income however it pumps my portfolio.

Just make sure you account for the added risk of NFTs in your portfolio Alexandra!

Yes I will. I only use my over budget then reinvest. I won’t be greedy, rest assured!