The Big Picture On Building Real Estate Equity Faster:

-

- Focusing on renovations that maximize return on investment, like cosmetic upgrades or essential improvements is an excellent way to create real estate value and equity.

- Increase value and generate extra income by adding features like rental units.

- Build equity faster by refinancing for better terms, making extra or bi-weekly mortgage payments.

Disclaimer

The information provided on this website is for general informational purposes only and should not be construed as legal, financial, or investment advice.

Always consult a licensed real estate consultant and/or financial advisor about your investment decisions.

Real estate investing involves risks; past performance does not indicate future results. We make no representations or warranties about the accuracy or reliability of the information provided.

Our articles may have affiliate links. If you click on an affiliate link, the affiliate may compensate our website at no cost to you. You can view our Privacy Policy here for more information.

Remember the story of The Little Red Hen?

She wants to bake bread, and at every step asks her friends for their help, but they all find excuses to avoid helping. Eventually she gets it all done herself and when her friends want to help her eat the bread, she says no.

The hen created something of value through work. She put in all the sweat equity over time – and she got to reap the reward.

Real estate equity works similarly. It takes knowledge and labor to find good deals on rental properties, and some work to manage them. But that knowledge and labor creates a barrier to entry, preventing every Tom, Dick, and Harry in the world from competing with you to invest in real estate.

Which in turn means you can earn higher returns on real estate investments than easy, universally accessible investments like stocks and bonds. Higher returns in the form of monthly real estate cash flow, higher returns from flips, and higher returns through building long-term real estate equity.

Here’s what you need to know about building equity in your properties, why building equity in your home is a good thing, and how you can build real estate equity faster.

What Is Real Estate Equity?

Real estate equity, whether in your home or an investment property, is quite simply the difference between what you owe on your mortgage and what the property is worth.

For example, if you own a property worth $150,000, and you owe $100,000 on the mortgage, you have $50,000 in equity.

Keep in mind that real estate equity exists on paper only. Tapping into it and actually accessing real cash from it requires you to either sell the property or borrow against it, both of which take time and cost money.

This means that your equity on paper and the actual cash you could access remain two very different things. If you were sell that property worth $150,000, you might incur $10,000 in closing costs such as Realtor fees, recordation fees, and other costs. So despite having $50,000 in equity on paper, you couldn’t actually walk away with $50,000 in your pocket by liquidating.

Reasons for Building Equity

Real estate equity offers multiple benefits to you as the owner, depending on your goals. You’ll have the opportunity to sell the property for capital gains of course, since that equity is essentially going into your pocket as a nice check at the time of sale. But the advantages don’t end there.

Another option is to tap into equity to buy more properties, using either a HELOC (try Figure, which even offers rental property HELOCs) or a blanket loan (try Visio). You get to leverage the equity you’ve accumulated in your existing rental properties or home to keep building your portfolio of assets.

If, for example, you wanted to use the equity in your home to purchase another home as a rental unit, you could use a HELOC and would only be required to make interest-only payments for the first ten years. This allows you time and flexibility for building real estate cash flow and any upgrades that might need to be made in the beginning.

You can also tap into real estate equity to take out a blanket loan instead of making a down payment. The lender secures a lien against your property with equity in it, in lieu of requiring a down payment.

Or maybe you’re looking to reach accredited investor status. Unlike home equity, equity in investment properties counts toward your net worth for qualifying as an accredited investor.

Building equity in your home is a good thing because the more equity you have, the more of your home you actually own, and the more money you’ll have available to invest and keep growing your wealth.

Other Creative Financing Options For Creating Equity

There’s a whole world of creative financing options that you can explore to build your equity. Don’t feel the need to limit yourself to the ones you know; explore your options and find out what fits better for your situation. Here are just some of them.

| Financing Option | Description | Pros | Cons |

|---|---|---|---|

| Seller Financing | The seller of the property provides financing to the buyer, acting as the lender. | Easier qualification, flexible terms | Potentially higher interest rates |

| Lease-to-Own Agreements | The buyer leases the property with an option to purchase it in the future. Part of the rent goes towards the purchase. | Builds equity over time, trial period for property | Higher monthly payments, risk of losing equity if not bought |

| Home Equity Line of Credit (HELOC) | A revolving line of credit secured by the equity in your home. | Flexible access to funds, low interest rates | Requires sufficient home equity, risk of foreclosure |

| Cash-Out Refinance | Refinancing an existing mortgage for more than the owed amount and taking the difference in cash. | Lower interest rates than other loans, one loan payment | Extends mortgage term, closing costs |

| Hard Money Loans | Short-term loans from private investors or companies, based on the property value rather than creditworthiness. | Fast approval and funding, flexibility | High interest rates and fees, short repayment period |

10 Ways to Build Real Estate Equity

Like the Little Red Hen, there are plenty of ways you can boost your equity and build it faster in your properties. Here are ten creative ways to build real estate equity fast.

1. Make Property Updates

Adding value directly to the property will immediately build equity in a home. Cosmetic updating, rather than renovating, usually offers the highest rate of return, according to the research by Remodeling Magazine. Rather than gutting an entire kitchen, which only adds an average of 51% of its cost to the value of a home, simply painting a neutral color and updating fixtures and appliances brings an 81% return.

Everyone wants to live in a modern-feeling home, but not everyone agrees on style decisions, so keep it neutral and new.

Storage space is always a hot commodity. No one likes hanging their best suit or formal dress in the unfinished basement with the smelly shoes, so extra storage and organization will always add value.

For more information, consider these preferred upgrades:

| Aspect of House | Description |

|---|---|

| Kitchen | Kitchen remodels offer a high return on investment, modernizing this space can significantly increase home value. |

| Bathrooms | Updating bathrooms can greatly enhance a home’s appeal and value, especially if they are outdated. |

| Exterior (Curb Appeal) | Improvements like landscaping, exterior painting, and door replacements can boost a home’s first impression. |

| Energy Efficiency | Upgrades such as better insulation, modern windows, and energy-efficient appliances can make a home more attractive and eco-friendly. |

| Usable Square Footage (e.g., finishing a basement) | Adding living space, such as finishing a basement, increases the functional square footage and appeal of a home. |

Making smart property updates will not only increase the value of a home, but will help the property sell for a higher rental price if you’re currently using it as a rental. There is an upper limit though, so stick to property upgrades that are genuinely necessary, not vanity projects.

2. Adding a Rentable Unit

Remodeling a space over the garage, the basement suite, or adding an income suite or accessory dwelling unit can help you produce more rental income. You can even do this with your own home to house hack and live for free!

You can take that extra income and add it to your current mortgage payment every month to accelerate building equity in your home.

By boosting the income your property can generate, it boosts your rental property’s value. Income suites also add to the value of your home, as accessory dwelling units continue to grow in popularity.

Of course, these are cost/benefit dependent. Generally, the basement suite or apartment over the garage are a much less expensive investment, since the structures already exist. However, adding an accessory dwelling unit in your yard gives you a little more privacy in your space. And nowadays you can even buy relatively affordable kits on Amazon that you can build yourself within a few days.

Either way, the extra money added to your mortgage every month is paying down the principal and building that home equity fast.

(article continues below)

3. Boost Curb Appeal

Not to beat the same drum, but everyone wants to live in an attractive, updated home. In fact, 75% of homeowners believe that keeping their exterior spotless is important. Another important fact is that boosting curb appeal has the highest rate of return on investment out of all remodeling and renovations you could choose.

Updates that saw the highest ROI were replacing the garage door, replacing windows, and adding wood decks and stone veneers. Even simple improvements like landscaping make a huge difference in the value of your home. These small capital investments increase the property’s value, instantly increasing your home equity.

It can also have a big impact on the amount you can ask for rent. Most people attach feelings to their home. When someone feels like they would be proud to live in that home (rather than feeling ashamed of like they want to run in the door with a paper bag over their head), they are willing and expect to pay more for that property.

4. Put More Down When You Buy

The more you put down on your property, the more equity you have in it from the very start.

If you buy with at least 20% down, you can typically avoid mortgage insurance (PMI), which improves your rental property cash flow.

When you can put down a bigger payment at purchase, you’re putting equity into that home in the form of cash to be reserved for future investment. While many investors aim to buy rental properties with no money down, it often proves more trouble than it’s worth to try and finagle the system.

5. Opt for a 15-Year Mortgage

It’s common sense that shorter loan terms mean building home equity faster.

When you opt for a 15-year mortgage though, you also typically pay a lower interest rate. Compounding that effect, you also make far fewer payments, which all means paying far less in total life-of-loan interest.

Shorter mortgage terms also move along the amortization schedule faster, so you spend less time in the initial high-interest phase.

6. Skip the Initial High-Interest Phase of your Mortgage

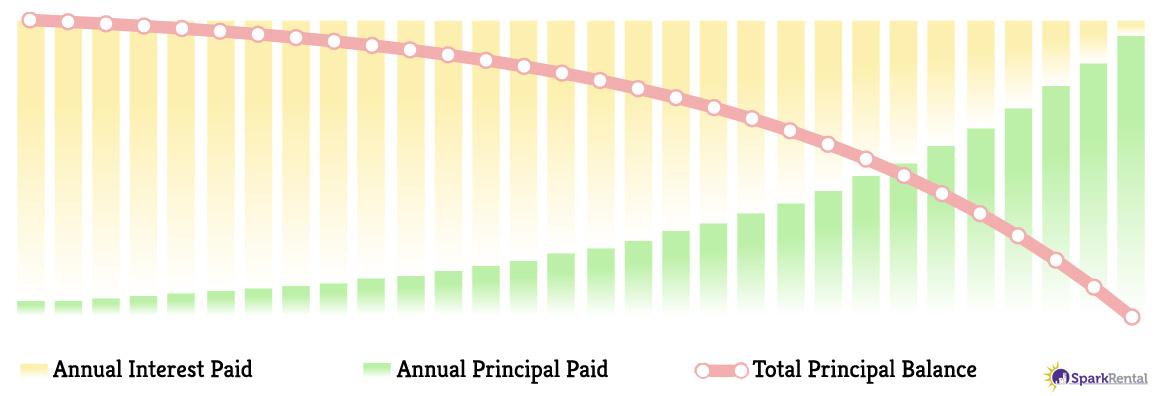

During the first years of your mortgage, most of your monthly payment goes to interest, not paying down your principal balance. As time goes on that begins to shift, and eventually when you near the end of your loan term, more of your monthly payment starts going toward paying down your principal balance.

If you make extra payments at the beginning, however, every penny would go towards the principal of the loan. This not only lowers your principal balance and creates equity, but it also saves you interest. You get to skip ahead in your amortization schedule, moving past the initial high-interest phase so that more of your regular monthly payment goes toward principal rather than interest.

Here’s how amortization looks visually, demonstrating how most of the principal payments and equity come from the last few years of the mortgage:

All of this means more of your money stays in your equity pocket, my friend.

This strategy can work as an alternative to a 15-year mortgage because it leaves you the option to pay the lower monthly payment in months when you’re stretched thin. It also lets you front-load the high payments and then sit back and enjoy better cash flow on your rental properties after a few years of paying extra.

7. Put Windfall Payments Towards Your Mortgage

You guessed it! Any and everything extra you choose to put into your mortgage builds real estate equity faster. Things like tax refunds, bonuses, gifts, and more can all be applied to your mortgage and will work to pay it down faster and build equity in a home.

Of course, many real estate investors and homeowners find the temptation to spend these windfalls hard to resist. But look at it from the perspective of your long-term goals. What is it that you truly want? Would you rather spend it now on new clothes or a vacation, or would you rather invest it in your properties and use it for building equity?

Sometimes you’ll be disciplined, and sometimes you might slip, and that’s okay! Remember that every dollar you add now builds equity and pays down your mortgage much faster. Think about what you really want and decide accordingly.

(article continues below)

8. Round Up

Rounding up your mortgage payment to the nearest hundred, five hundred, or thousand-dollar mark can rapidly shrink your mortgage every year. This is one of the best ways to be psychologically sneaky about building equity, because once you automate your monthly loan payment, you tend to forget about it.

Every dollar you pay towards your mortgage on top of your monthly payment goes right to reducing your principal balance and skipping that high-interest initial phase of the loan. You save money on interest and build real estate equity, all on auto-pilot.

9. Switch to Bi-Weekly Mortgage Payments

When you pay bi-weekly instead of monthly on your mortgage, you can structure it so you pay 26 half-month payments per year. That works out to paying one full month extra every year, which all goes to principal, pushing more money into your mortgage and building that equity – all without feeling burdensome.

Over 12 years, that’s one full year extra you’ve paid into your mortgage, just for switching from monthly to payments every two weeks. This is also a very manageable way to pay, because it runs on the same pay schedule as your paycheck!

10. Get Rid of the PMI… But Pay Like You Haven’t

If you have purchased your home with less than 20% down, you know all about private mortgage insurance (or PMI). However, once you have 20% equity in your home, many loan programs let you apply to remove it.

You want to ditch it as quickly as possible to stop wasting money on it every month. But to build home equity faster, continue to make the same payment you were making with it. The extra dollars will go to your principal balance, and every single dollar helps.

Final Thoughts

Property owners build real estate equity faster in two main ways: improving the physical property and reducing the mortgage.

Often, a healthy mix of both of these will diversify your game plan, and help you create real equity faster, in a sustainable way. There are instances where some strategies are better for some situations, investment goals, or market conditions, so get the lay of the ground and prepare to be flexible.

Making smart, simple upgrades to both the inside and outside of the property, or adding a rental suite, will boost rental income and resale value. It can instantly build home equity by increasing property value and cash flow.

Putting your extra dollars to work for you by pumping them into your mortgage, paying down the principle quickly and cutting the interest, puts more funds into your asset to be used as equity in future investments, or to pay off your mortgage entirely and supercharge your rental cash flow.

No matter the type of property you have, it has the potential to become a solid financial spring if you implement these simple strategies for building equity.

How do you plan to build equity faster in your properties? What strategies for boosting real estate equity have worked well for you in the past? Share your thoughts below!

I am interested in learning more about HELOC. I do not have any properties yet other then my home. However I have built a lot of equity and now contemplating using that to start investing.

HELOCs can be a great flexible way to tap into equity in your home to help you buy more rental properties, pay it back, then do it all over again. One thing that’s worth noting is that it’s not an ongoing line of credit like a credit card – typically there’s a draw phase (when you can draw on the credit line, pay it down, draw again, etc.) and a repayment phase, where it locks and you have to start paying it off for good.

Keep us posted on how it goes!

Adding rental units is my current project to boost my equity. I’ll follow the other tips you got here to build more equity. Thanks for the tips!

Glad to hear it George!